By Kieran Kirwan, CAIA

U.S. equity investors face an interesting allocation question in 2025: Why buy anything other than the S&P 500?

After watching large caps dominate the investment landscape over the prior 10 years or so, in some ways, that view may seem valid. However, we think it’s time to diversify. As investors broaden their bets to other parts of the capitalization spectrum, the most compelling opportunity could be high-quality mid-cap stocks.

Senior Investment Strategist Kieran Kirwan explains why high quality mid-caps may present a compelling investment opportunity in the current environment.

Why it May be Time to Invest in Quality Mid-Caps

The transformational AI narrative and strong earnings growth from the Magnificent-7 technology stocks have propelled much of the S&P 500’s stellar performance the past couple of years. Multiple expansion, however, has also been a major driver. That leaves investors in the bellwether cap-weighted S&P 500 with two major concerns:

- Extended valuations,

- A high degree of concentration

Over 30% of the S&P 500’s weight lies in its top 10 holdings, which leaves the index highly—or some might say overly—reliant on the continued dominant performance of a small number of listings. Consider how vulnerable even the Mag-7 really are. Additional “DeepSeek moments” could emerge if more low-cost entrants join the AI arms race. Optimistic earnings expectations could falter, threatening currently soaring price-to-earnings (P/E) [1] multiples. Or maybe it’s a yet unforeseen threat. Regardless, recent events have shown there are clear chinks in the armor.

Two common potential antidotes to the concentration dilemma include:

- Equal weight strategies

- Small-cap strategies

An equal weight solution by itself may not be enough, however, as it effectively means overweighting lower-quality names. Allocating to small-caps also typically means sacrificing quality, as many small companies struggle to turn a profit.

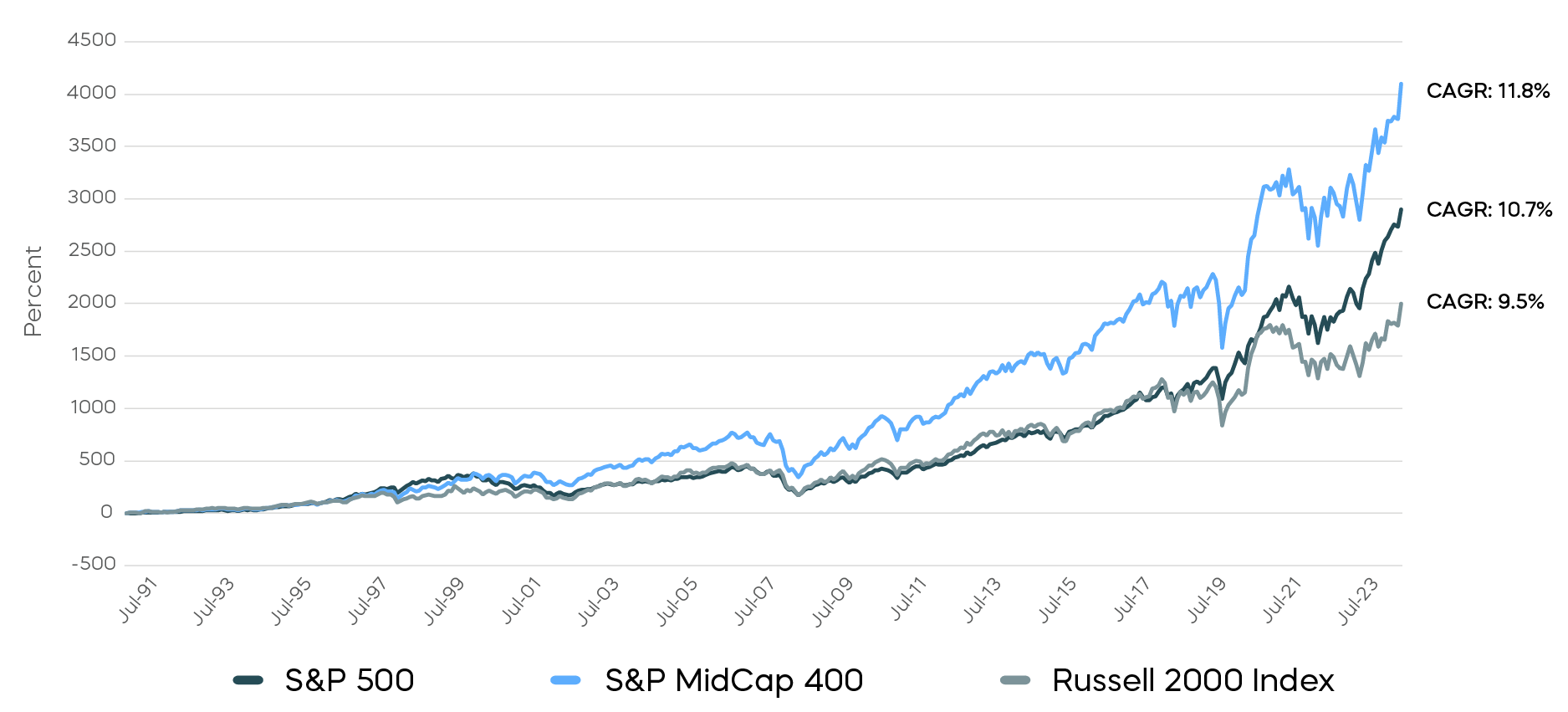

Mid-cap stocks, meanwhile, appear poised to deliver. Investors have come to understand the mistake of ignoring this “sweet spot” in the domestic stock universe. Since July of 1991, the S&P MidCap 400 has outperformed both large-cap and small-cap stocks, and done so consistently, beating the S&P 500 in over 75% of rolling 10-year periods.

Mid-Cap Stocks Have Outperformed Over Time

Source: Source: Bloomberg. Data from 7/1/1991 to 11/30/24. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

According to Bloomberg, The S&P MidCap 400 has been trading at just about 60% of the price-to-earnings multiple of large-caps recently, making them potentially a better bargain. And with expected earnings growth of roughly 15% in 2025—which is largely insulated from tariffs, as over 75% of mid-cap revenues come from domestic sources [2]—mid-caps could have a more attractive risk/reward trade-off. Our view remains that investors should consider going one step further by focusing on high-quality mid-cap stocks with a track record of dividend growth.

What Makes a Mid-Cap Dividend Aristocrat?

The Dividend Aristocrat brand is well known to investors looking to invest in high-quality companies with the longest records of consistent dividend growth. Many investors intuitively associate dividends with iconic large-cap brand names. What’s often missed, however, is the similar dividend growth longevity of mid-cap stocks. Their names may be less familiar, but their dividend records are generally no less impressive.

The S&P MidCap Dividend Aristocrats Index is a distinguished group of 54 companies that have grown their dividends for at least 15 consecutive years. Over half of them have grown their dividends for more than 25 consecutive years. And they generally come with the attributes of quality that investors expect of the Aristocrats, including:

- Durable competitive advantages, solid fundamentals, and management teams that are committed to returning capital to shareholders.

- Higher gross and net profit margins than the broader index, with more consistent levels of earnings growth through the market’s ups and downs.

- Lower levels of debt than the broader S&P MidCap 400.

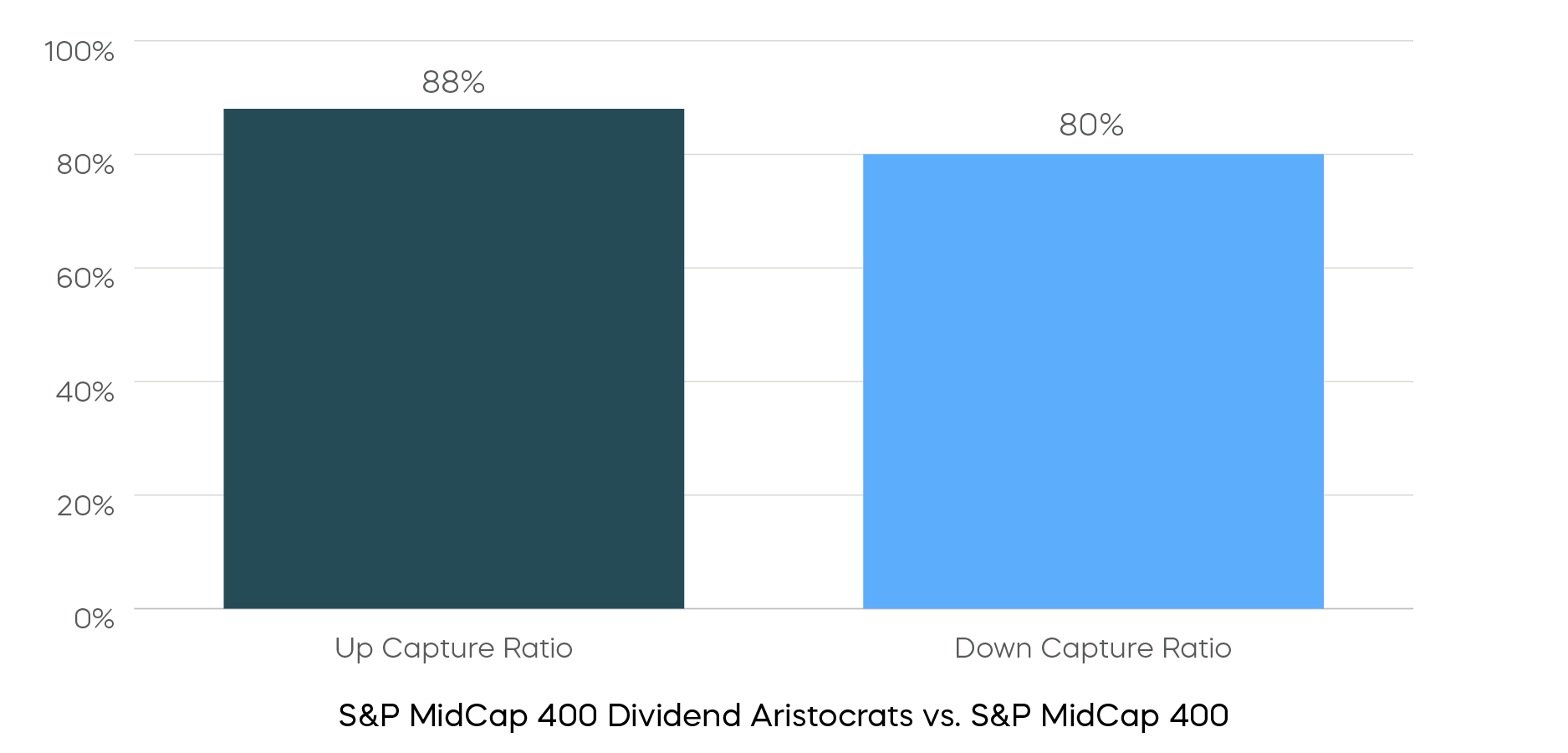

Since its inception in 2015, the S&P MidCap 400 Dividend Aristocrats Index has outperformed the broader S&P MidCap 400, with lower levels of volatility. The mid-cap Dividend Aristocrats have also demonstrated a history of weathering market turbulence over time by delivering most of the market’s upside in rising markets, with considerably less of the downside in falling ones. This has been a valuable feature in times of uncertainty.

Mid-Cap Aristocrats Have Had All-Weather Performance

Source: Bloomberg. Data from 1/5/2015 to 12/31/24. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

The Takeaway

Mid-cap stocks appear to be a compelling opportunity in 2025. Since its inception, the S&P MidCap 400 has not only outperformed the S&P 500 but done so consistently, beating large-caps in over 75% of rolling 10-year periods. Mid-caps may offer a better fundamental outlook than large caps, often trading at a significant discount to the S&P 500 despite expectations of attractive earnings growth. High quality mid-caps, like the S&P MidCap 400 Dividend Aristocrats, are especially worthy of consideration by investors looking for attractive all-weather performance over time.

[1] Price-to-earnings (P/E) shows how much investors are paying for a dollar of a company's earnings. P/E helps to assess the relative value of a company’s stock by measuring its share price relative to its earnings.

[2] Source: FactSet, based on company revenue data as of 1/31/25.

Learn More

REGL

S&P MidCap 400 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P MidCap 400® Dividend Aristocrats® Index.

NOBL

S&P 500 Dividend Aristocrats ETF

Seeks investment results, before fees and expenses, that track the performance of the S&P 500® Dividend Aristocrats® Index.

SMDV

Russell 2000 Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 2000® Dividend Growth Index.

TMDV

Russell U.S. Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the Russell 3000® Dividend Elite Index.

TDV

S&P Technology Dividend Aristocrats ETF

ProShares S&P Technology Dividend Aristocrats ETF seeks investment results, before fees and expenses, that track the performance of the S&P® Technology Dividend Aristocrats® Index.

EFAD

MSCI EAFE Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI EAFE Dividend Masters Index.

EUDV

MSCI Europe Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI Europe Dividend Masters Index.

EMDV

MSCI Emerging Markets Dividend Growers ETF

Seeks investment results, before fees and expenses, that track the performance of the MSCI Emerging Markets Dividend Masters Index.