Jump To:

Key Observations

Stocks had a strong 2024, with the S&P 500 up 21% leading into November.[1] Since the election, markets have rallied to even higher levels. That means investors, many of whom were worried about stock valuations before the election, have much to consider heading into 2025. Will policy changes be enduringly bullish for stocks? How strong are the fundamentals supporting the current rally? What might the rate-setters at the Federal Reserve do?

Our characterization of the year ahead? There seems reason for some exuberance—but a rational exuberance, based upon a plausible foundation of corporate and economic health. Our key observations for 2025 include:

- Stocks May Have Less Risk Than You Think

- Fixed Income Markets Face Challenges

- Equity Income Presents Opportunity

- Bitcoin May Be a Diversifier

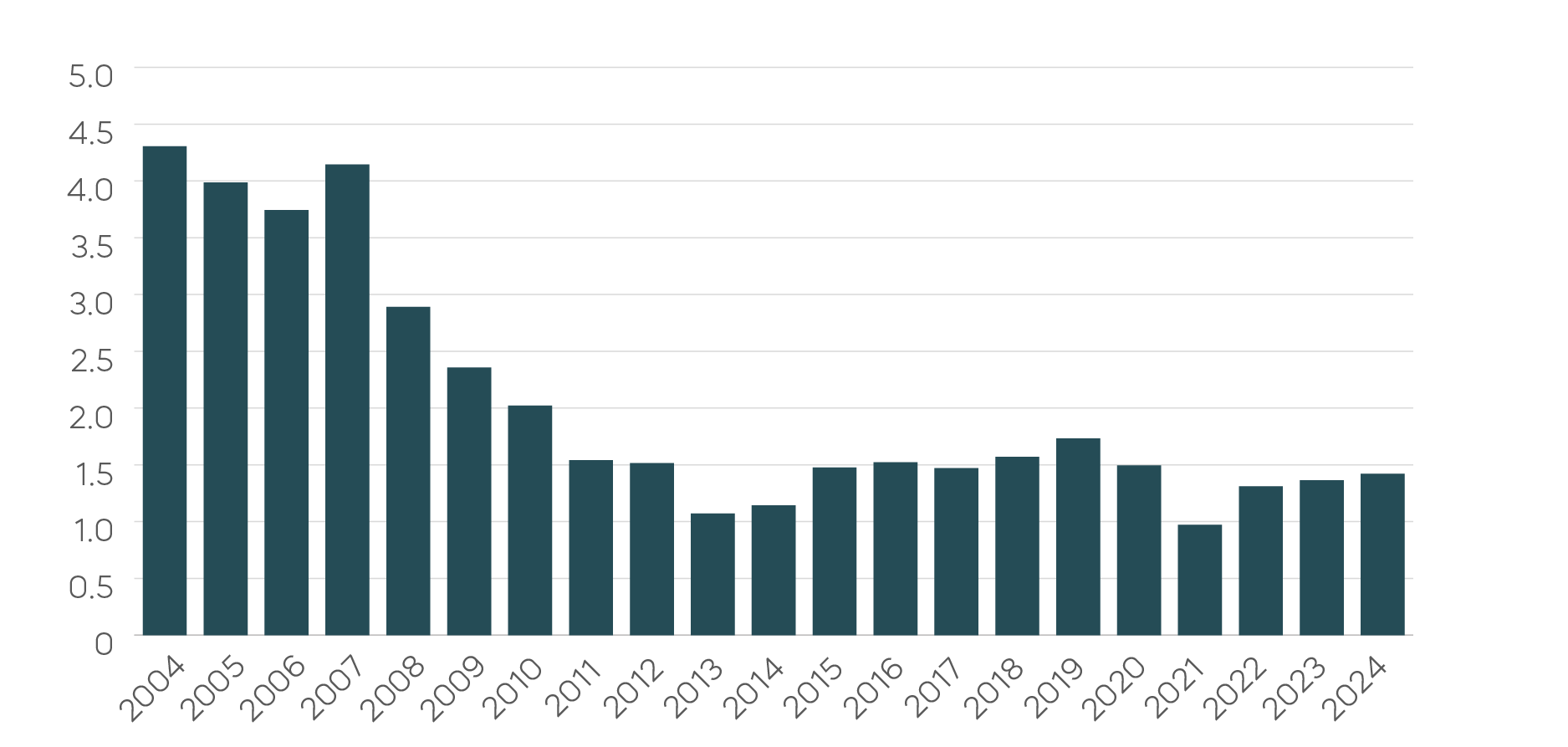

There’s no getting around the fact that stocks are expensive. With the 10-year Treasury yield near its long-term average of 4-4.5%, a typical range for a stock’s trailing price-to-earnings (P/E) multiple would be 18-20X.[2] It currently stands at roughly 25X.[3] What might have changed to make an elevated P/E multiple be less risky for investors? The answer is leverage. Stocks have less than a quarter of the leverage today than they had 20 years ago, with S&P 500 net debt/EBITDA falling from 5X to close to 1X today. That is a substantial reduction in financial risk.

Bloomberg data as of 12/5/24 Net debt/ EBITDA measures a company’s ability to pay off its debt by utilizing earnings before interest, taxes, depreciation and amortization (EBITDA). Past performance does not guarantee future results. Index calculations do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

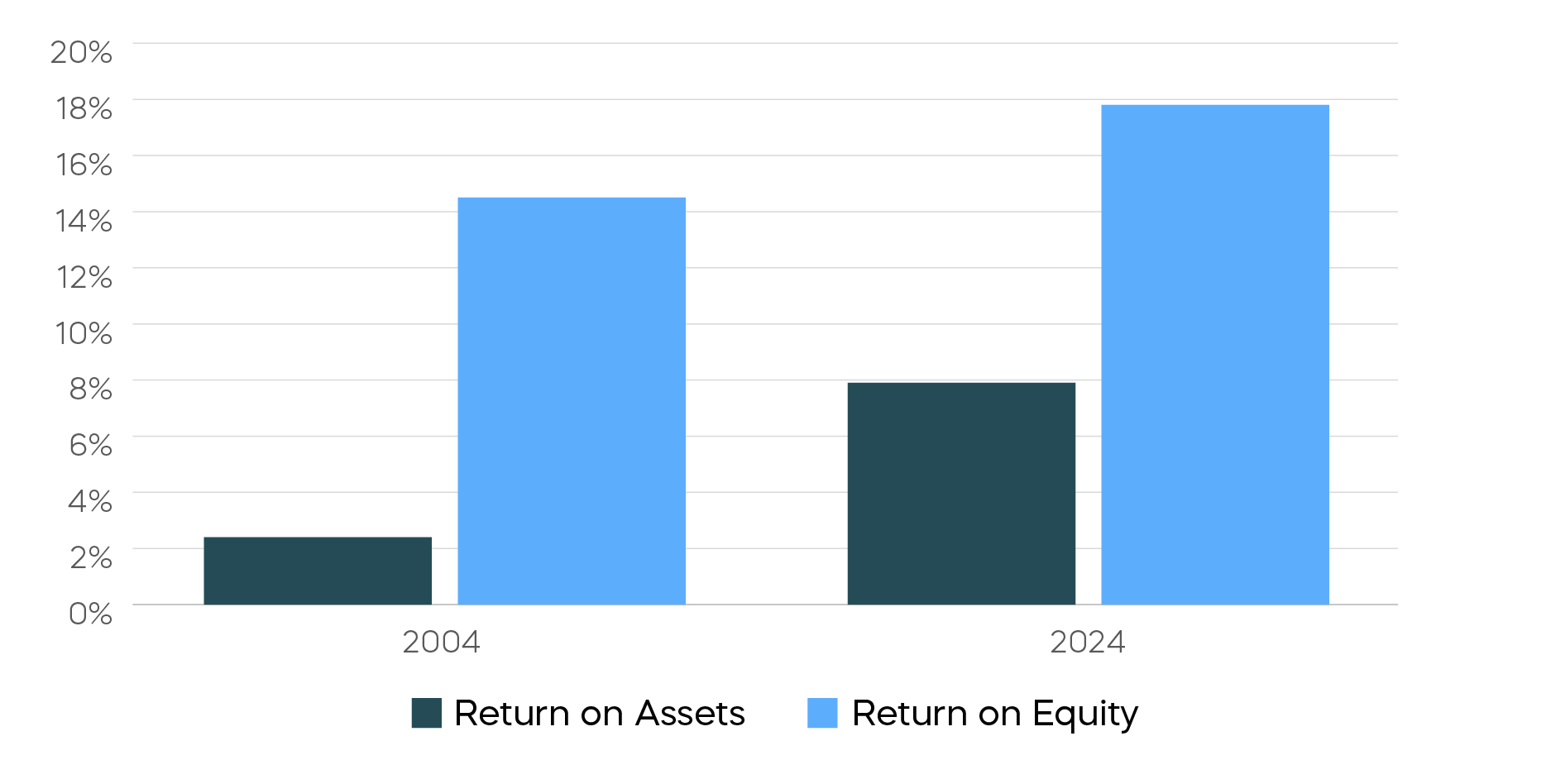

Another way to illustrate today’s currently lower levels of leverage is to compare the return on assets (ROA) of the S&P 500 with return on equity (ROE).

Source: Bloomberg data as of 12/5/2024. Return on equity is a measure of profitability calculated by dividing net income by shareholder equity. Return on assets measures how efficiently a company is using its assets to generate profits, calculated by dividing net income by total assets. Past performance does not guarantee future results. Index calculations do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

Investors who simply look at this comparison would see a notable, albeit unremarkable, increase in ROE from 20 years ago. But ROE is driven by two components: the ROA of the underlying business and the amount of leverage that converts the ROA into ROE. As shown in the chart above:

- In 2004, high leverage drove an ROE that was six times that of the ROA of the underlying business, while in 2024 that multiple was just a bit more than two times.

- Today, the profitability of the underlying business of the S&P 500—the ROA—is more than triple that of 20 years ago.

Is that improved ROA enough to justify a 25X P/E multiple? It could be. The significant decline in leverage of the S&P 500 and the robustness of today’s profitability (due in part to the technology sector) suggests that at least some of the exuberance that drove expanding multiples may, in fact, be rational.

There are two key challenges facing fixed income investors in 2025:

- The risk of inflation

- Tight credit spreads

Possible tax cuts and tariffs do pose a potential inflation risk. Here’s how that might play out for bonds: If history is a guide, the real yield on the 10-year Treasury should be between 2%-2.5%. Thus, if inflation gets down to the Fed’s 2% target, the resulting 10-year Treasury yield should be 4%-4.5%, where it is today. But if inflation stays persistently closer to 3%, that 10-year Treasury yield could rise to over 5%.

The federal funds rate tells a similar tale. A 10-year Treasury yield roughly 1.5% higher than the federal funds rate is a good long-term rule of thumb. So, if the rate eventually gets down to 3%, we are looking at that same 4.5% yield. But if inflationary pressures stop the Fed at 3.5% or more, we might end up with that 5% handle. Since yields up means prices drop, there could be a price risk for longer-term Treasurys.

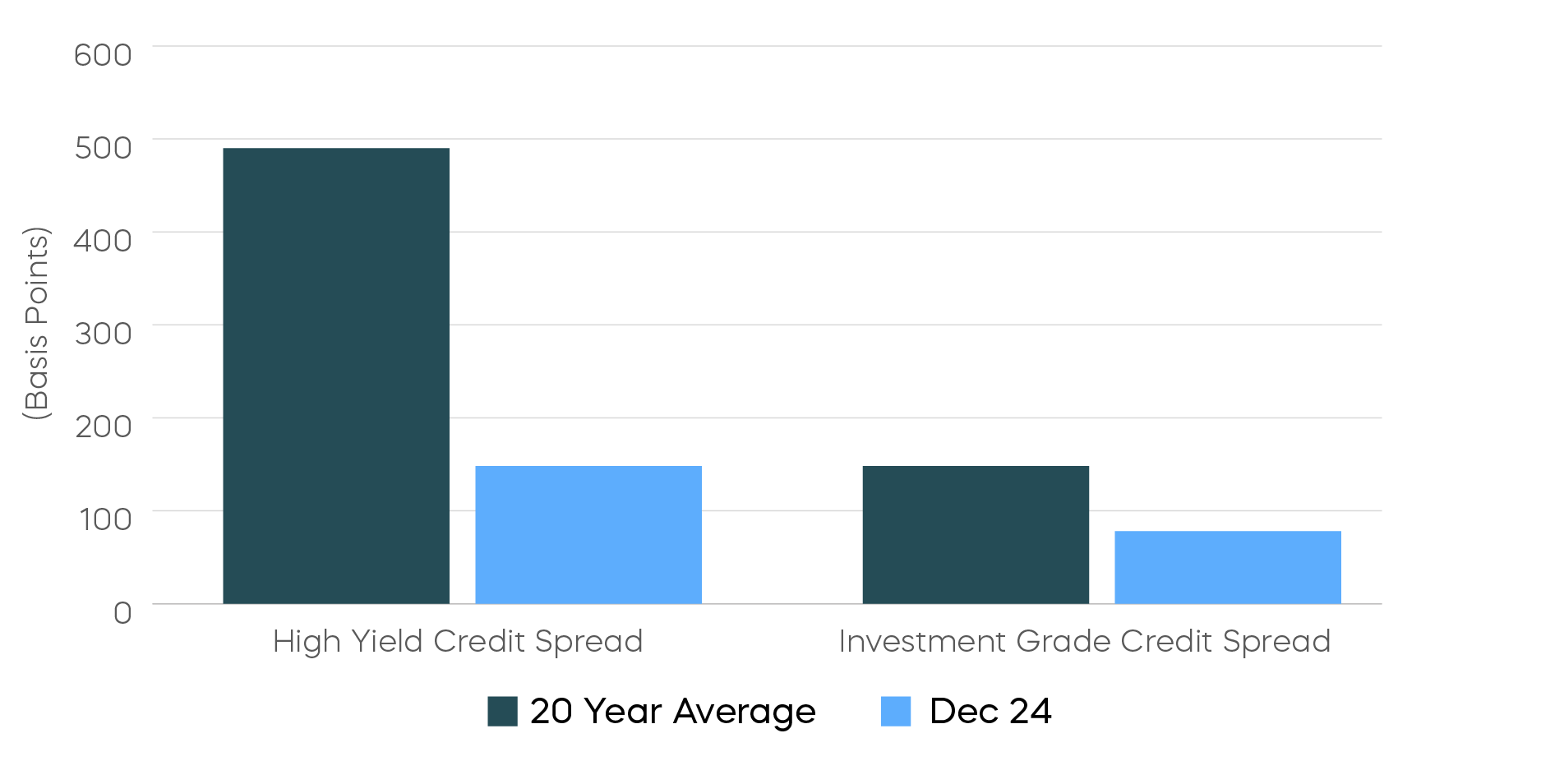

Corporate bonds may face challenges as well. In addition to interest rate risk, credit spreads are tight, with both high yield and investment grade spreads close to half of their 20-year average.

Source: Bloomberg data as of 12/2/2024. Past performance does not guarantee future results. Index calculations do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index.

That’s a tough trade for bonds at a time when stocks may look more appealing. For stocks, lower corporate leverage translates into a little less risk in credit, so the potential market upside for equities is a fair trade. Corporate bonds, on the other hand, offer little additional yield, little upside potential, and the added risk that spreads could widen and prices fall.

Even in a positive market for fixed income, many investors simply cannot generate sufficient yield from their bond allocations to meet their needs. As bonds absorb the challenges we’ve just discussed for the year ahead, the situation may become even more acute.

Faced with such concerns, investors might consider trimming their fixed income allocations. However, if they decide to stay in bank deposits, money market funds, or CDs, the Fed’s rate cutting could continue to reduce their income as well.

Instead, investors searching for yield may turn to income strategies tied to equities. Using equities to generate income is not a new pursuit. However, traditional approaches to equity income typically come with difficult tradeoffs. For example:

- High-yielding equities such as real estate investment trusts (REITs), master limited partnerships (MLPs), and other groups of high-yielding stocks have often underperformed and can exhibit bond-like risk to higher interest rates.

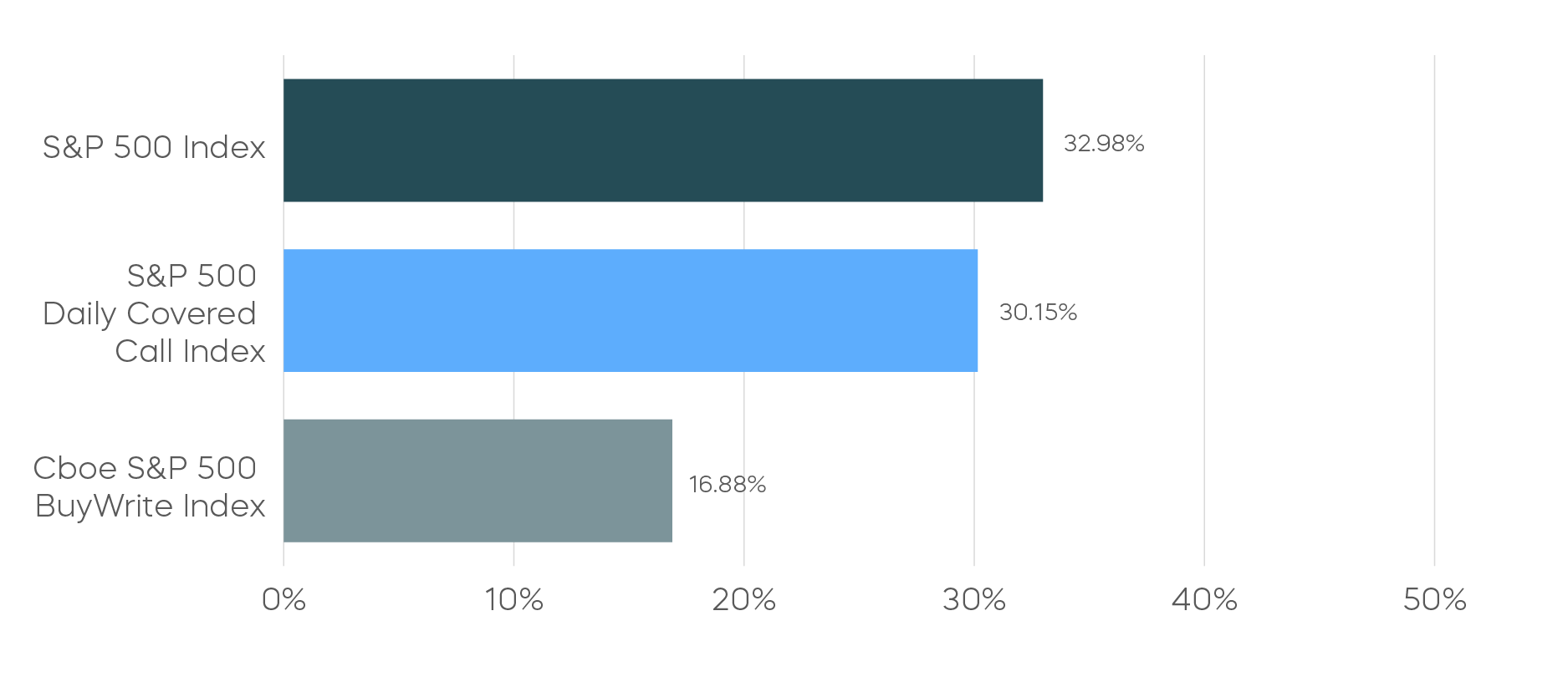

- Traditional monthly covered call strategies do a nice job of generating income but, by design, they give up a substantial portion of equity returns.

In contrast, a covered call strategy driven by daily options (which are tracked by the S&P 500 Daily Covered Call Index) offers the potential for high income, the opportunity to target equity returns, and may capture the long-term returns that traditional covered call strategies usually sacrifice. Such an opportunity—to have an equity investment that performs like equities, while delivering a potential for high income—may be a timely option in the year ahead.

Bitcoin’s record run to $100,000 in late 2024 has made headlines, but asset allocators have another reason to consider the cryptocurrency.

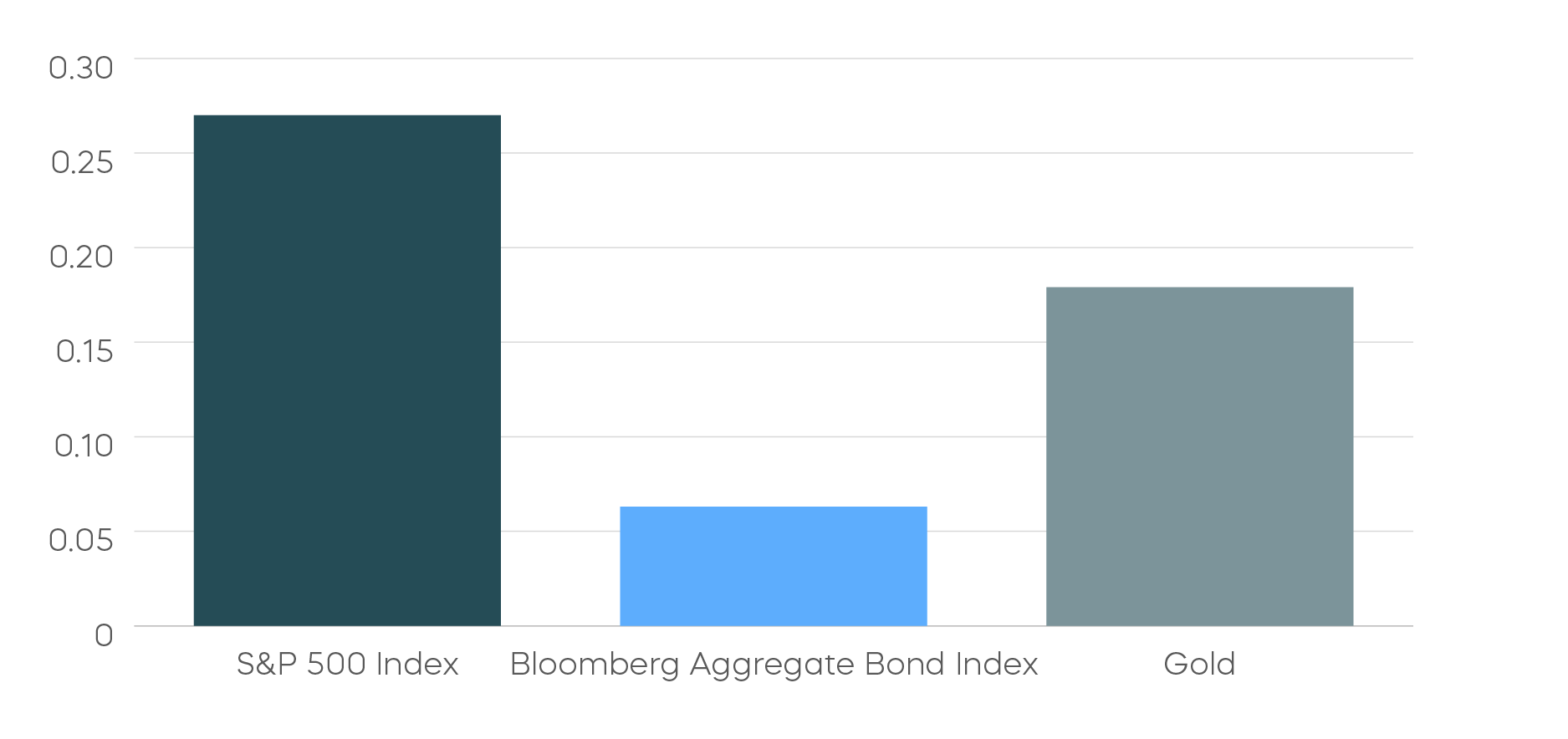

Given its meteoric rise, there is an increasingly common view that bitcoin is a risk asset like others, and that it will generally rise and fall with the stock market. That isn’t necessarily true.

Source: Bloomberg, data as of 12/2/24. Past performance does not guarantee future results. Index calculations do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

In fact, bitcoin has shown quite low correlation to the stock market over time, as the chart above shows. It has also demonstrated low correlations to bonds and even gold, two key pillars of diversification from equities.

If these correlations cause you to raise an eyebrow, consider the following: During the regional banking crisis in early 2023, which saw the failure of crypto-related banks, bitcoin was surprisingly resilient. March of 2023 saw the S&P 500 Financials Sector fall nearly 10%, while bitcoin rallied over 22%.[4] Without arguing over whether bitcoin’s current record price is justified, investors should remember that the addition of a small amount of a volatile and uncorrelated asset to a portfolio has the potential to materially increase portfolio efficiency.

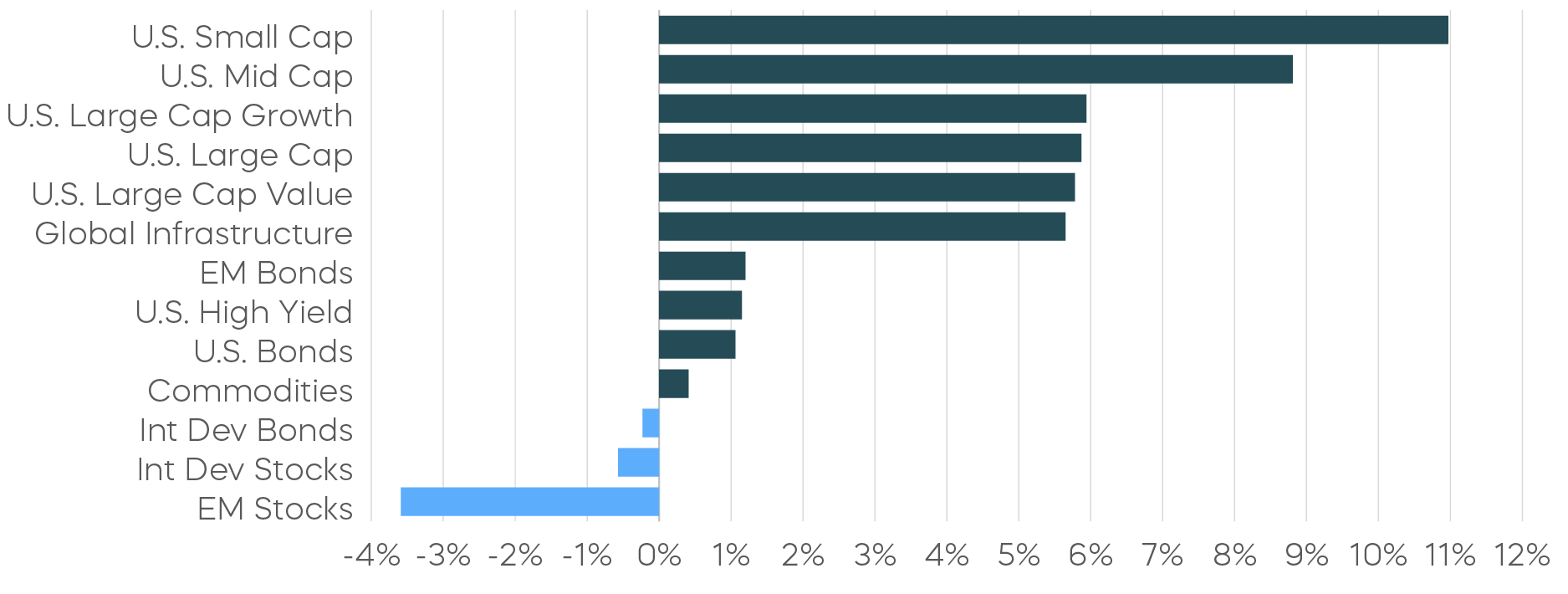

A decisive outcome in the U.S. presidential elections was received positively by investors who pushed markets to several new highs during November. Mid- and small-cap stocks provided leadership, and helped close the gap with large-cap-growth stocks which maintained their lead on a year-to-date basis.

Source: Bloomberg. November returns 11/1/24–11/30/24; year-to-date returns 1/1/24‒11/30/24. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

There are many uncertainties (and some significant challenges) to investing in the year ahead. But with equities rallying post-election, and support from fundamentals like reduced leverage and historically strong levels of ROA, there seems to be reason for rational exuberance for equity investors in 2025. For fixed income, headwinds may be stronger given tight credit spreads. That, coupled with less attractive yields across the market thanks to Fed rate cuts, may make equity income opportunities, like covered call strategies driven by daily options, attractive to investors in need of both income and long-term growth.

Equity Perspectives

It appears that 2024 will go down as another strong year for the equity market. Supported by a resilient economy, healthy corporate earnings, broadening market participation in the current rally, and a bit of market history, the potential is high for the bull market to continue into next year. Key perspectives to keep in mind for the year ahead include:

- History and Fundamentals Both Support Equity Market Strength

- Expect Broader Market Participation to Continue

- The Opportunity for Income is From Equities

The S&P 500 has the potential to finish 2024 with gains of well over 20%, marking the second consecutive calendar year of such a result. However, even with a strong economic backdrop, expectations for a favorable regulatory regime, and an accommodative Federal Reserve, the contrarians among us may be tempted to predict a decidedly different outlook for stocks in 2025.

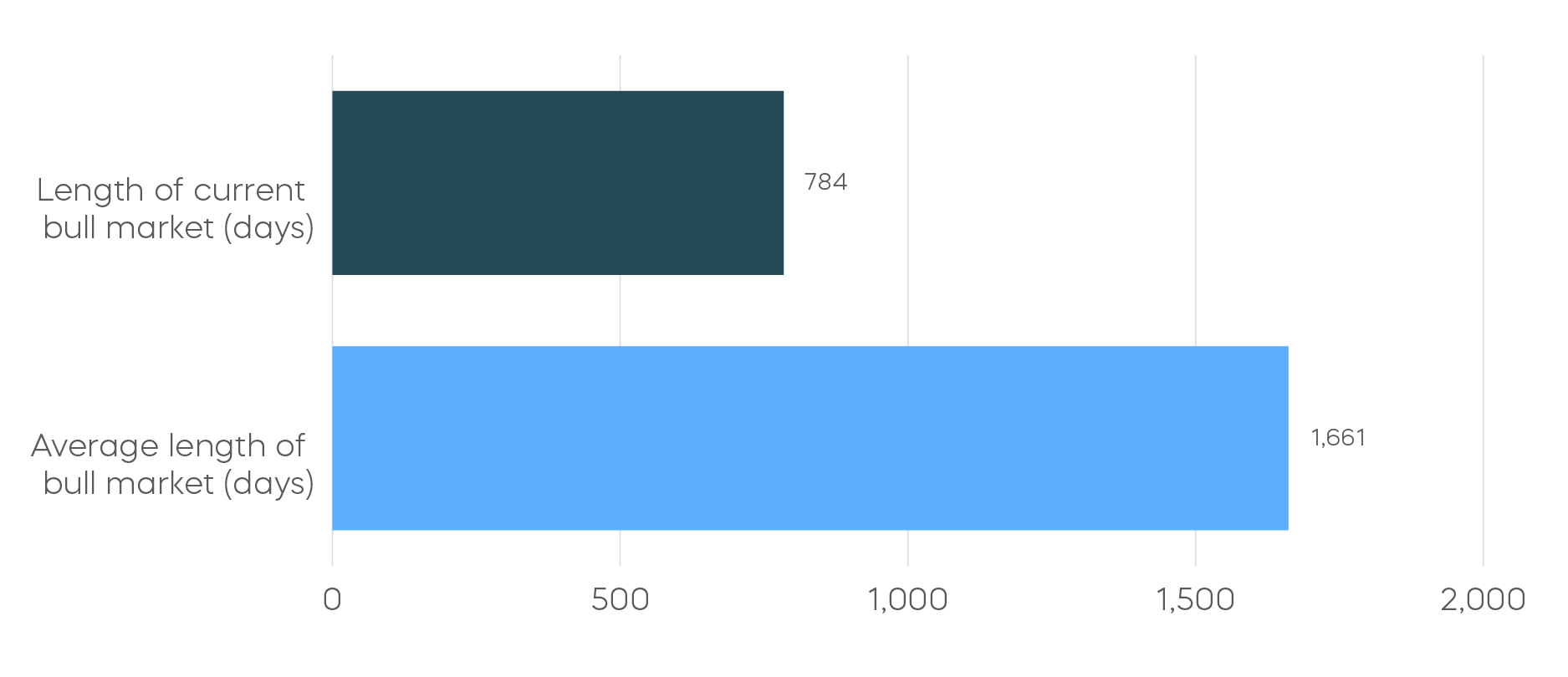

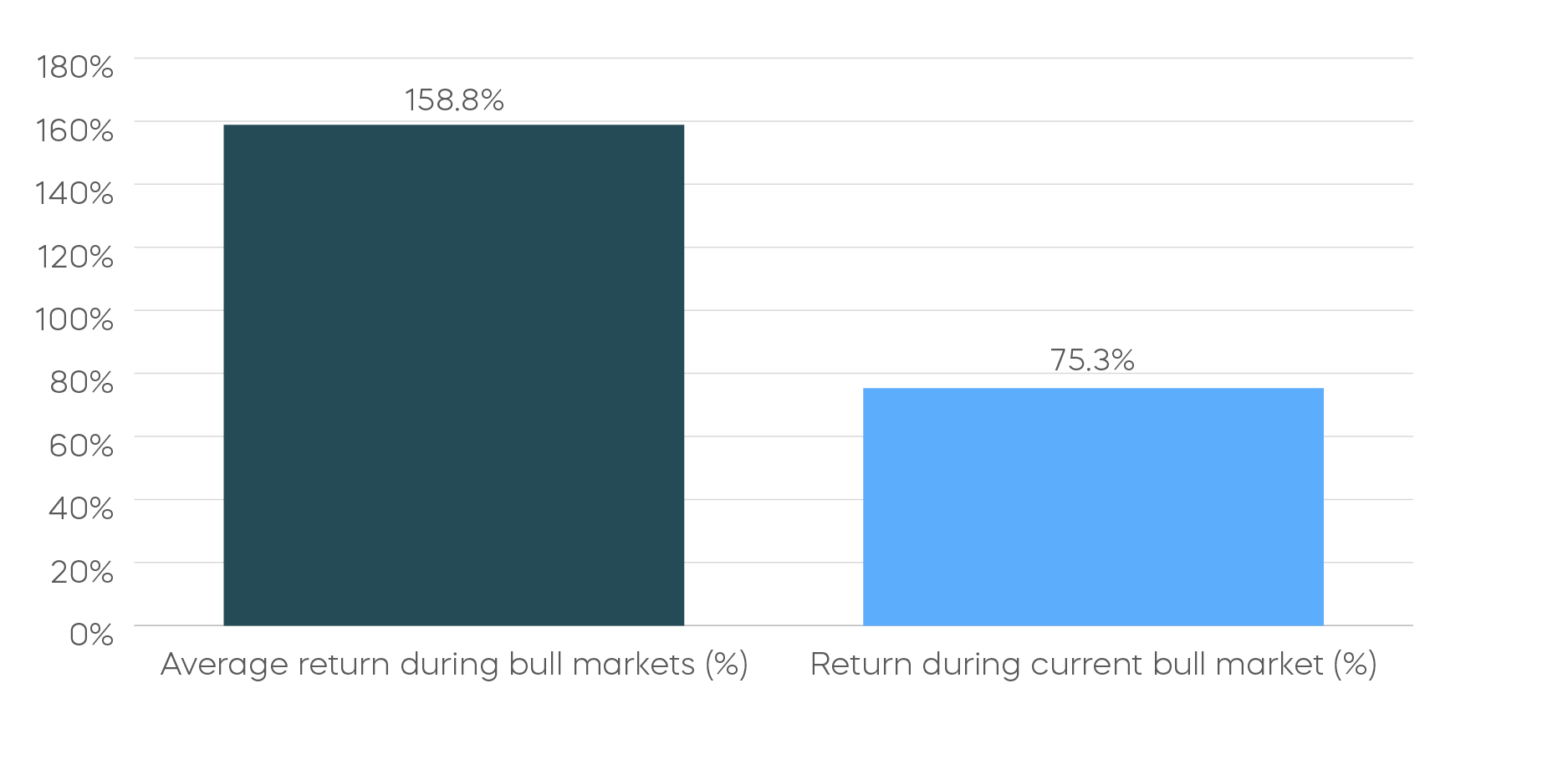

But history and fundamentals suggest the bull market that began on October 12, 2022 has further room to run. According to Bespoke Investment Group, the average S&P 500 bull market since 1949 lasts 1,661 days and produces average returns of over 158%. If you compare those figures to the current bull market, it is still relatively young and has thus far produced returns that are less than half of the historical average.

Source: Morningstar data and Bespoke Investment Groups. Data through 12/4/24. Past performance does not guarantee future results.

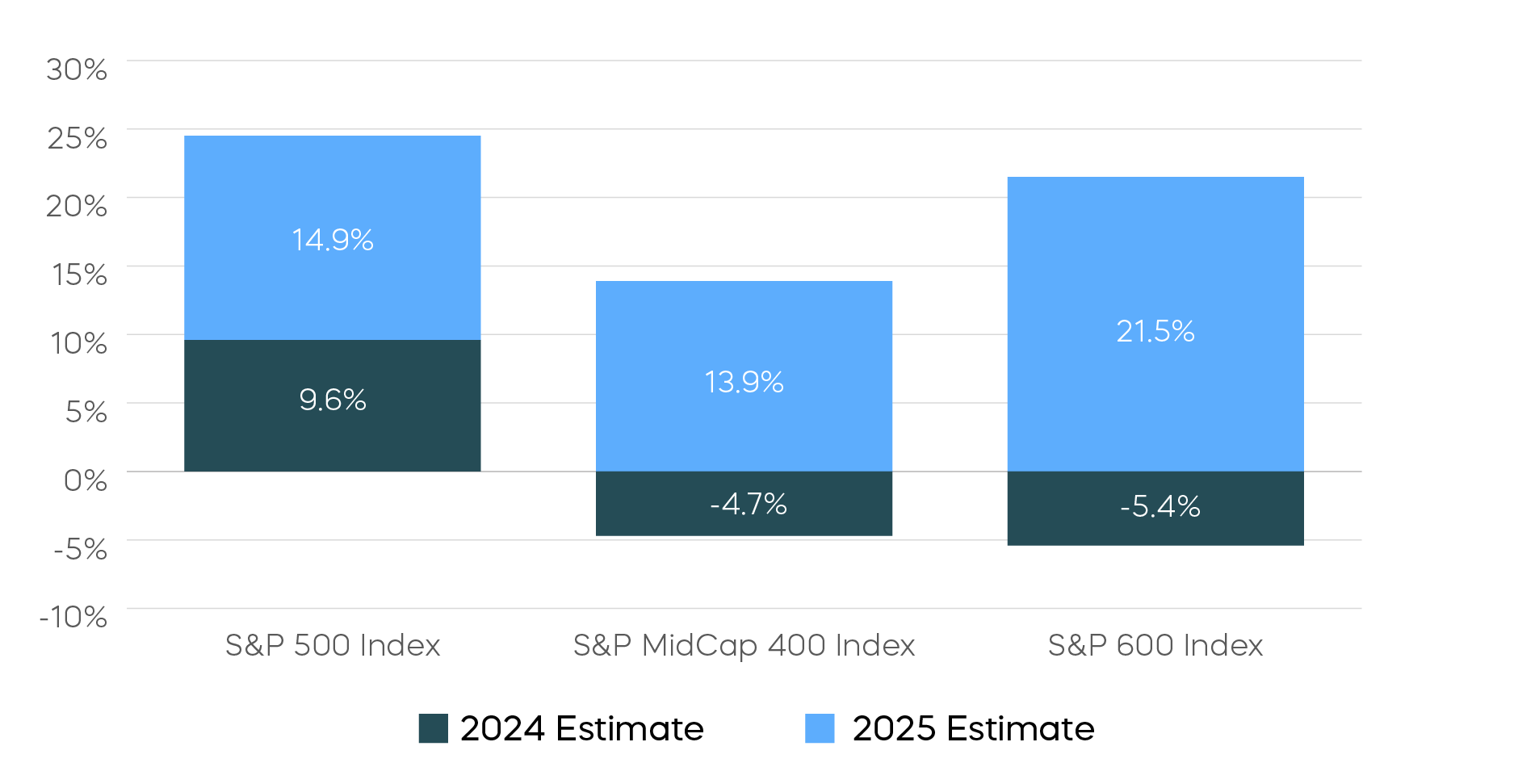

The current bull market may also be buoyed by good old-fashioned earnings. Unlike in 2023, when the S&P 500 rallied sharply based almost exclusively on multiple expansion (rather than growing profits), earnings momentum has recently been building. According to FactSet, the expected earnings growth trajectory across the market-cap spectrum is expected to improve significantly during 2024—before accelerating even further in 2025.

The upshot is that further gains may be supported by robust earnings growth over the next two years, potentially allowing large caps to grow into today’s extended multiples.

Source: FactSet, data as of 12/3/24. Past performance does not guarantee future results.

During the first half, returns were concentrated among a small number of “momentum” stocks, largely in the technology sector. And it was believed that market participation needed to broaden for the rally to continue. As we noted in our October Market Commentary, this wish was granted mid year.

Technology and growth stocks have not led markets since July. At the sector level, tech shares have been among the weakest performers since then, with returns of just 3.5% according to Morningstar. Meanwhile, utility, consumer discretionary, and financial stocks have all advanced by more than 20%.

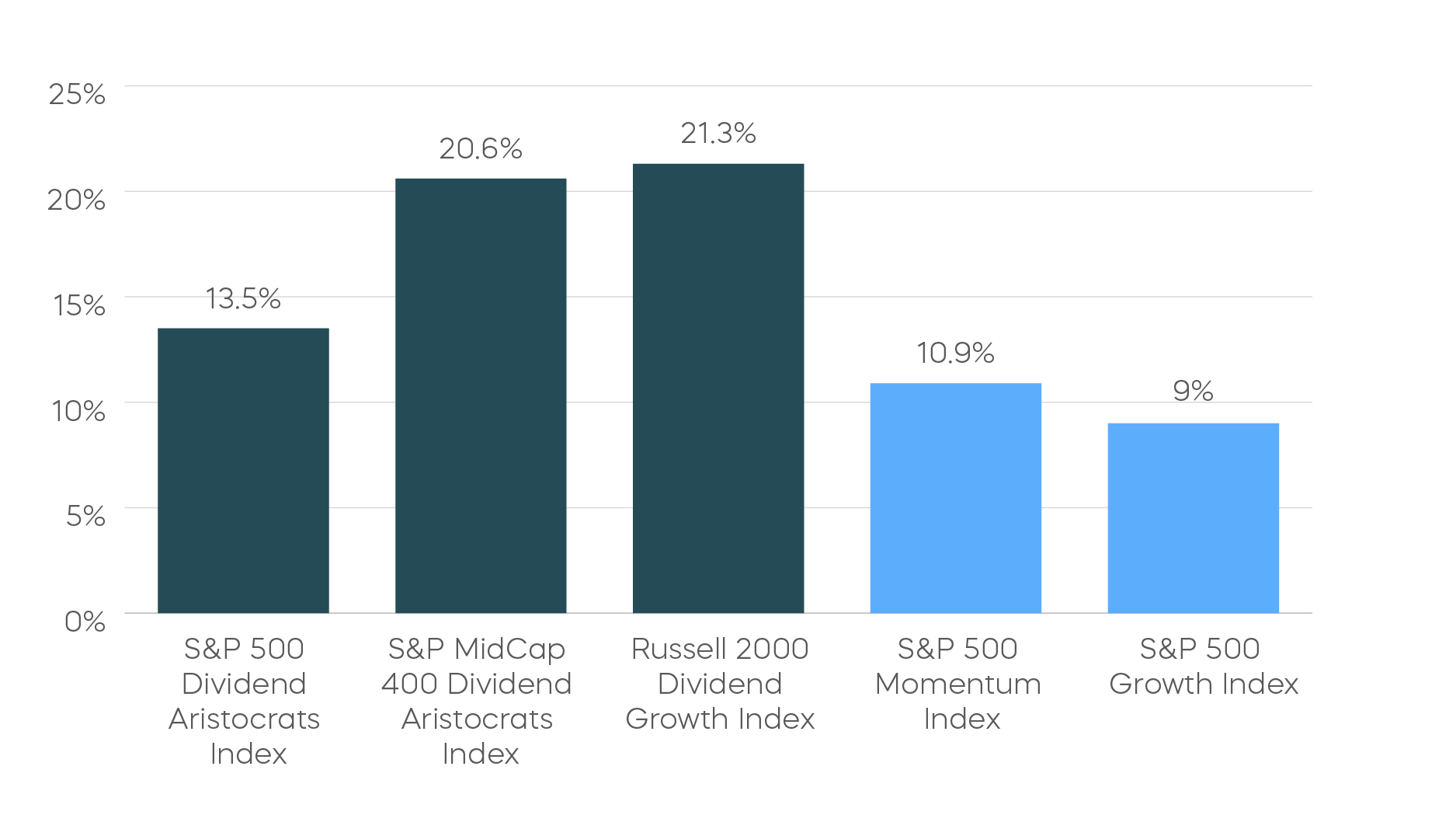

Perhaps more notably, smaller-company stock performance has accelerated, with the S&P SmallCap 600 outperforming the S&P 500 by 7.9% and the S&P MidCap 400 outperforming by 4.5%. High-quality dividend growth strategies across the market cap spectrum have also outperformed their parent market indexes, with especially strong returns among mid- and small-cap dividend growth strategies.

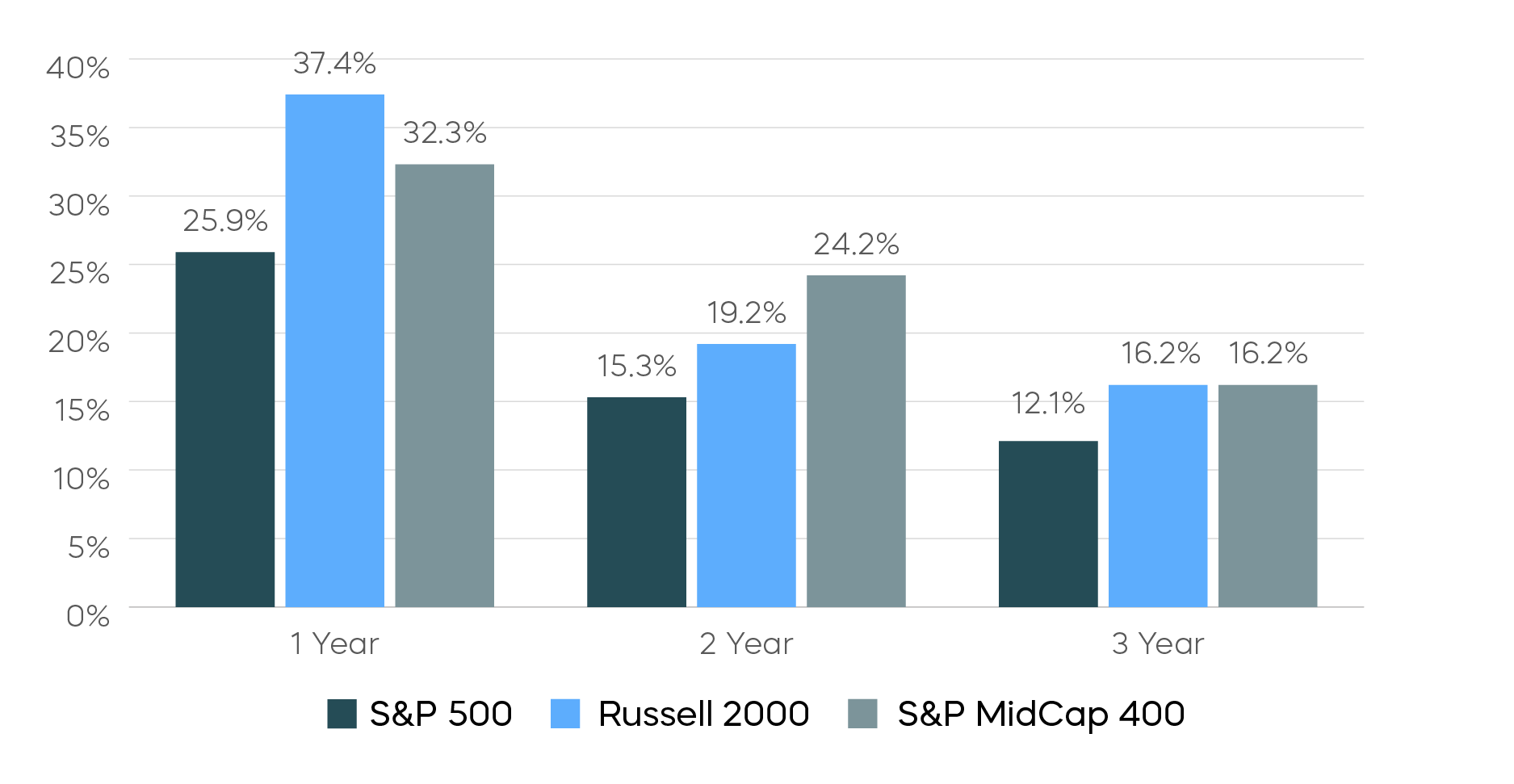

There’s reason to expect that smaller-company stock performance will continue to be strong in 2025. Since prices typically lead fundamentals, we anticipate that higher stock prices may be indicative of a gradually improving earnings trajectory for small cap stocks into 2025. And even though the number of interest rate cuts may be slowed by continued economic and labor market strength, both mid- and small-cap stocks have fared particularly well following the Fed’s five prior rate cutting cycles.

Source: Bloomberg, data as of 9/30/24. Data shows the average 1-, 2-, and 3-year performance subsequent to the final rate cut of the prior five Fed rate cut cycles. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Energy has been largely absent from the recent rally and may struggle into 2025. Prices for oil and natural gas haven’t moved much this year, and it’s expected that major producers will not significantly raise output despite President-elect Trump’s mantra of “Drill, baby drill.” According to Bloomberg, the U.S. has increased crude oil production by 45% over the past decade and now faces a probable surplus next year that could continue to weigh on prices. Also, according to S&P Global, most other producers seem focused on capital efficiency rather than increasing output. Finally, the energy sector is facing an estimated 23% earnings contraction for the fourth quarter of 2024, and it is the only S&P 500 sector with a negative sales growth forecast for 2025, according to FactSet.

Bonds are finally producing decent yields again, but equity markets may offer a more compelling way to generate income in 2025 for two reasons:

- Fixed income faces challenges from potential inflation and credit spreads. Historically, tight spreads leave little room for further compression, and amid ongoing rate volatility, longer-term yields could move higher and pressure returns.

- Equity income solutions offer potential income that is not correlated with interest rates.

In this way, equity income solutions serve to both diversify income sources and offer higher levels of initial yield—with income that can grow over time.

Equity income strategies have earned an increasingly prominent role in investor portfolios over the last several years. Two in particular are worth noting: covered call strategies that use daily options to generate high levels of current income, and dividend growth strategies that have consistently grown income over time.

A covered call strategy that uses daily rather than monthly options—like the S&P 500 Daily Covered Call Index—has the potential to deliver annualized yields of approximately 10%. The strategy also targets the returns of the S&P 500, meaning investors can potentially capture returns that traditional monthly covered call strategies often sacrifice. Investors may also pair income from option-related premiums with other investments, including high growth stocks or small-cap equities via the Nasdaq-100 Daily Covered Call Index or the Cboe Russell 2000 Daily Covered Call Index.

Similarly, dividend growth strategies—like those based on the S&P 500 Dividend Aristocrats Index—have historically delivered income growth at a faster rate than the S&P 500. Hypothetically, $1 million invested in the S&P 500 Dividend Aristocrats Index at its inception in May of 2005 would have generated a cumulative income of over $1.1 million as of November 30, 2024, an amount 59% greater than the S&P 500.[5]

Coming off the heels of a strong year, supported by expanded market participation and expectation for accelerating earnings, there’s good reason to believe the still-young equity market rally we’ve seen in 2024 will continue into 2025. And amid the potential for bond-related headwinds, investors focused on income may find that innovations in daily covered call strategies, as well as historically resilient dividend growth stocks, will become increasingly attractive in the year ahead.

Fixed Income Perspectives

Fixed Income Markets Face Policy and Inflation Questions

As fixed income investors make plans for 2025, many are scrutinizing the potential impacts of President-elect Trump’s policies. His agenda, including plans for increased tariffs and corporate tax cuts, raises questions about how financial markets might respond. With fixed income at a crossroads, we are closely monitoring three key areas:

- Credit Fundamentals Appear Strong, but Spreads Seem Priced for Perfection

- Term Premium Reflects a Post-QE World, Though Inflation Risks Persist

- Rate Cuts Likely to Continue, but Economic Optimism Could Shift Their Path

Credit Fundamentals Appear Strong, but Spreads Seem Priced for Perfection

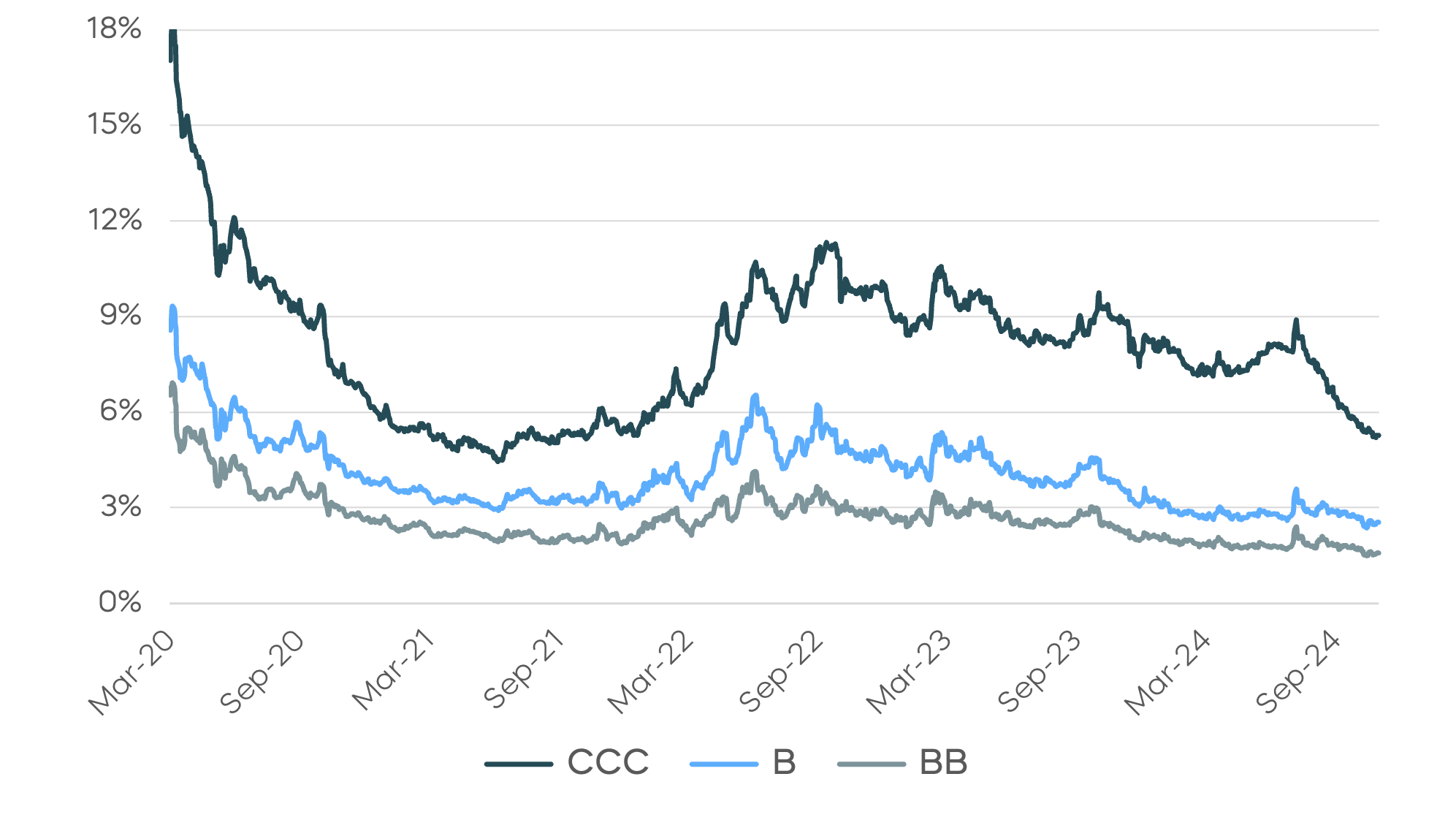

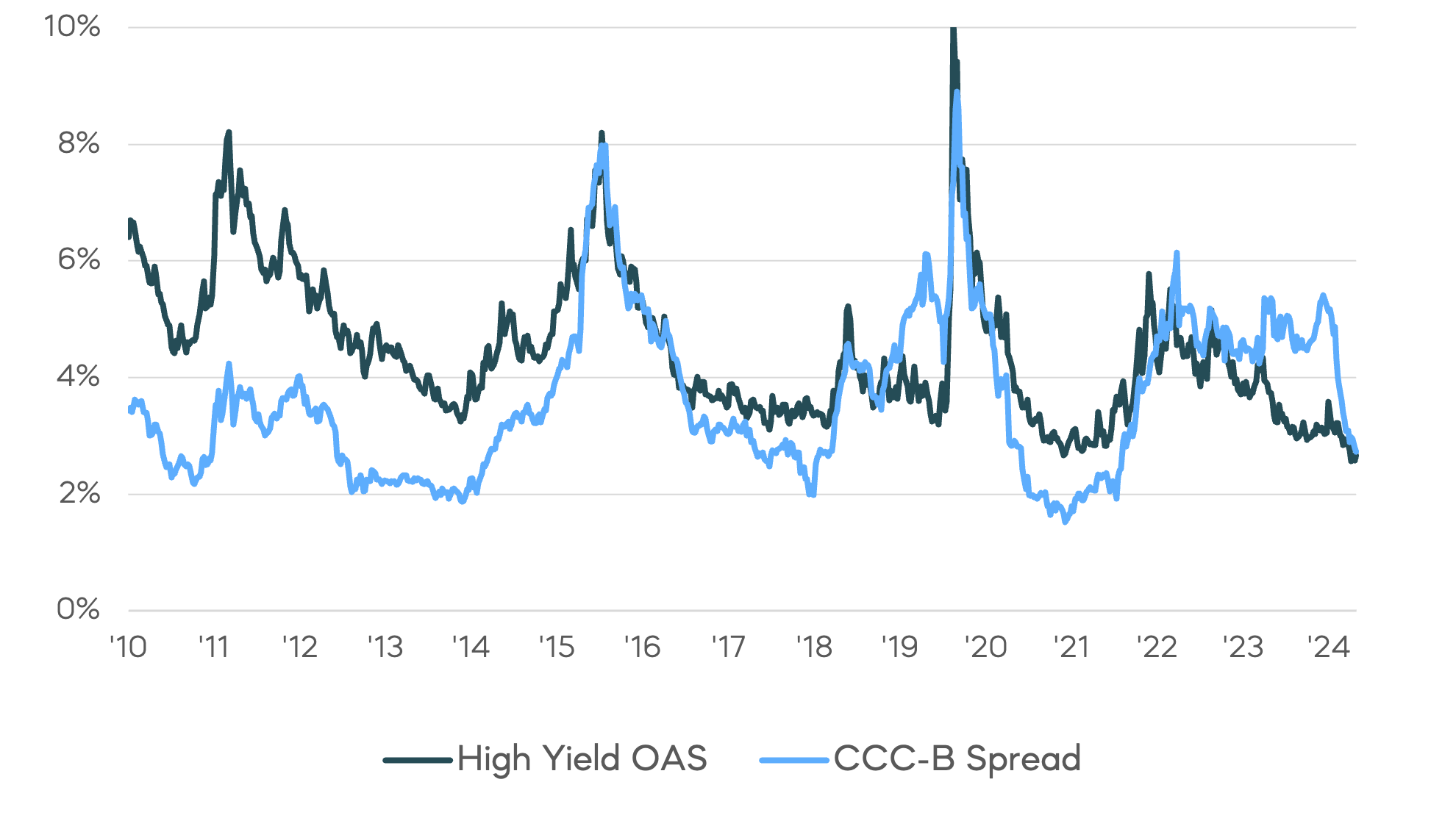

A bull market for credit gained traction in late 2024 after the Federal Reserve commenced its rate-cutting cycle in the third quarter. Meanwhile, tight credit spreads are signaling lenders see little default risk. Not only have high-quality, high-yield spreads surpassed their post-Global Financial Crisis (GFC) lows, spreads on CCC-rated bonds are also approaching their post-GFC lows.

In recent years, heavily leveraged and lower-rated borrowers faced significant pressure from rising interest rates, with the spread between CCC-rated and B-rated bonds remaining elevated even as overall high-yield spreads reached record lows. However, this dynamic shifted in the second half of 2024, as the spread between CCC and B-rated credits narrowed from the ninetieth percentile (post-GFC) at mid-year to the thirtieth percentile by late November.

This shift underscores the extent to which investors have been reaching for yield amid strong credit fundamentals. The U.S. economy successfully avoided a recession in 2024, leverage ratios remained healthy, and lower interest rates eased borrowing costs for companies with floating-rate or short-term debt. Additionally, many companies refinanced debt and extended debt maturities. This all seems to support a favorable outlook for lower default rates in 2025.

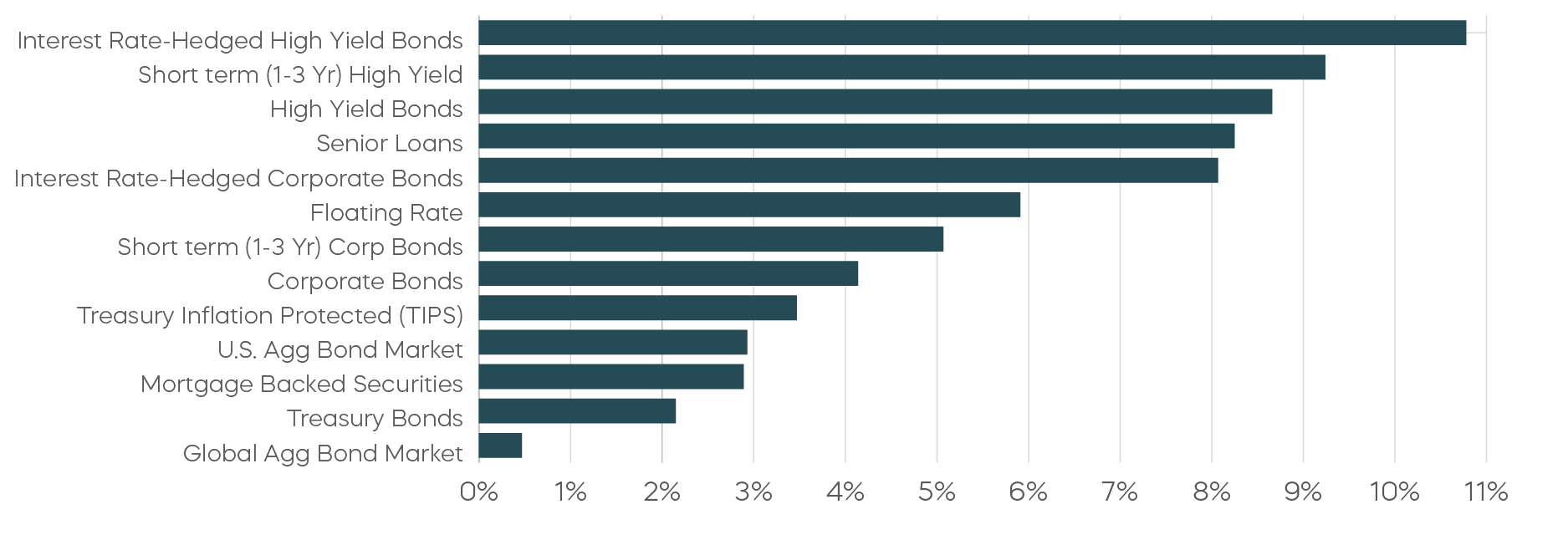

While default risks may remain low, valuations have stretched significantly. Price risk becomes more one-sided when there’s limited room for further spread compression. Historically, high-yield bonds have delivered returns of approximately 300 basis points over Treasury bonds, net of default-related losses. However, with current spreads already below this historical threshold even before accounting for any default losses, returns may fall short of historical norms. This prompts the question of how much tighter spread credit investors are willing to accept.

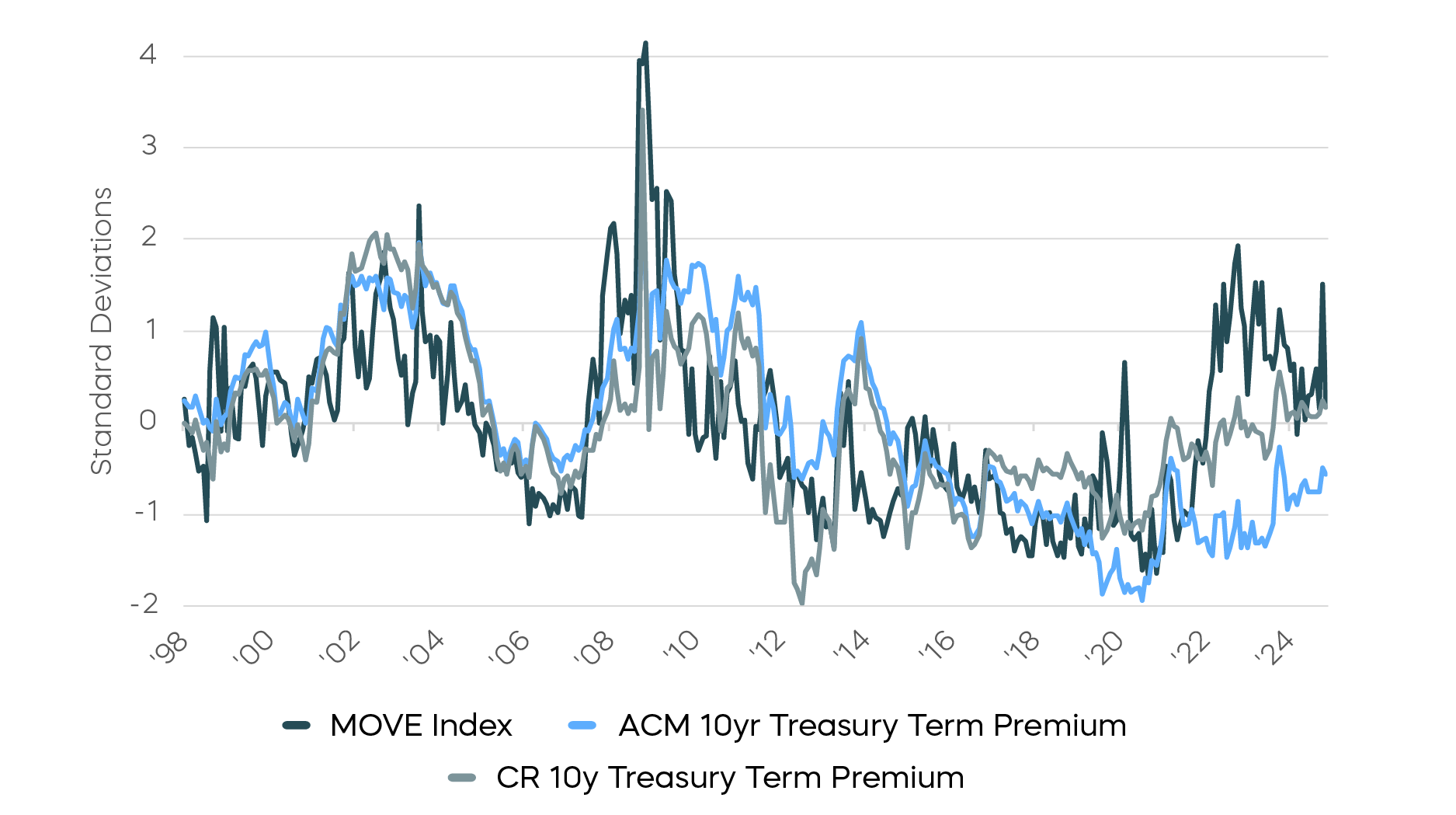

During the 2010s, deflation—not inflation—was the dominant risk across most developed economies. Short-term interest rates were often kept near zero, and quantitative easing suppressed long-term interest rates. This contributed to a decline in term premium, which is the additional yield investors demand for holding longer-term bonds. In contrast, the post-COVID era brought inflation back into focus, driving both term premiums and interest rate volatility higher.

Initially, the rise in term premium trailed inflation and interest rate volatility, which spiked higher. However, as the Fed tightened and inflation gradually moved toward its target, term premiums continued to increase, narrowing the gap with interest rate volatility, as measured by the MOVE Index. While term premium is often used as a shorthand for the simple difference between the 10-year Treasury yield and the Federal Funds Rate, true term premium is not directly observable. There are various models for estimating the term premium by projecting the average expected path of short-term rates. The San Francisco Fed’s CR model currently estimates that the present term premium is consistent with the level of interest rate volatility, suggesting that an adjustment to a post-QE world has taken place.

The question for investors next year is how policy changes will influence inflation. Proposed measures such as tariffs and reduced immigration could increase costs for goods, services, and labor. However, fiscal debates and uncertainties surrounding policy implementation might temper these inflationary pressures. Productivity improvements driven by efficiency initiatives may also offset inflation risks. With the election introducing new upside risks to inflation, it will be crucial for investors to closely monitor how term premiums adjust as policy details become clearer and are put into effect in 2025.

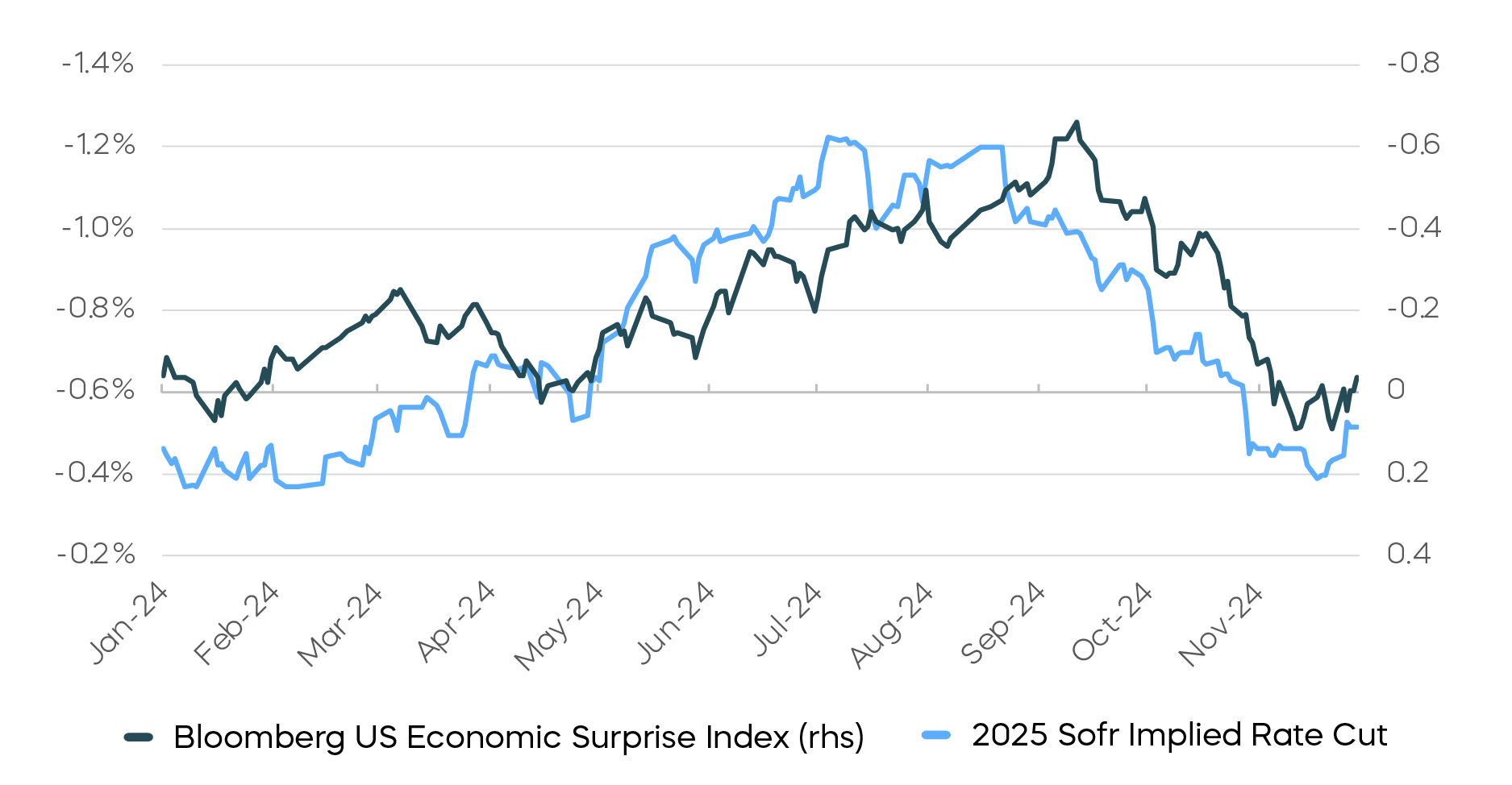

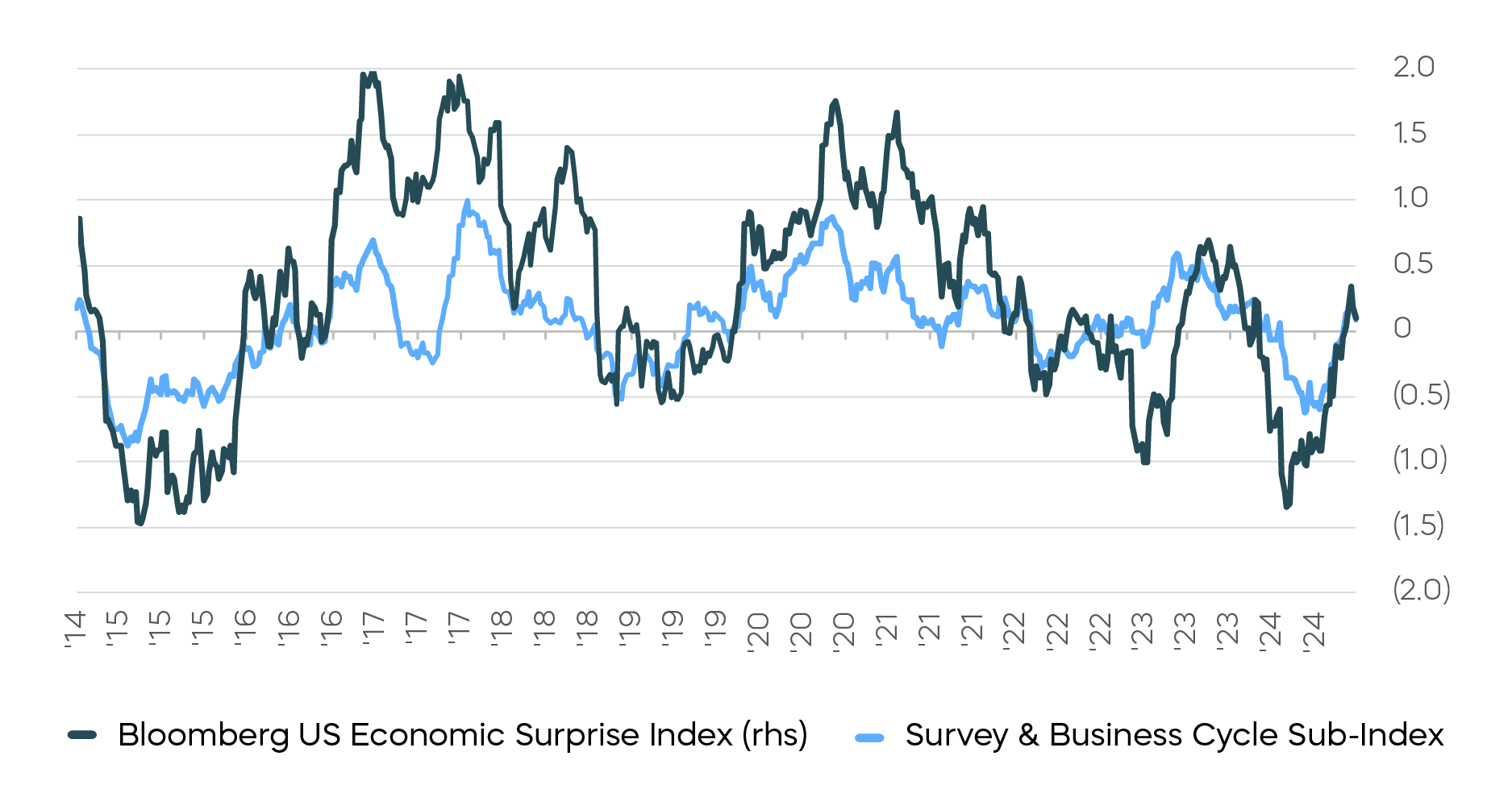

At the September FOMC meeting, the Federal Reserve pivoted from tightening to easing, initiating a 50-basis-point rate cut. At that time, Secured Overnight Financing Rate (SOFR) futures implied there would be more than five 25-basis-point rate cuts throughout 2025, exceeding the Fed's own projections. Since then, market expectations have moderated to just two+ cuts, falling below the Fed’s September forecast. While it is likely that the election contributed to this change in expectations, the market also saw less need for easing as the economic outlook improved. Notably, rate cut expectations have closely tracked economic data surprises throughout the year.

Going forward, pro-growth policies may further invigorate "animal spirits," as captured by survey-based soft data. For example, indicators like the Purchasing Managers’ Index (PMI), consumer confidence, and business sentiment reflected stronger economic activity during the first half of President-elect Trump’s previous term, and could show a similar resurgence.

Source: Bloomberg, data as of 11/30/24. Past performance does not guarantee future results.

Despite these dynamics, we anticipate the Fed will maintain its easing bias, unless incoming data significantly exceeds expectations. On one hand, the Fed acknowledges that prior tightening has disproportionately impacted certain segments of the economy, particularly low- and moderate-income households. On the other hand, the Fed may feel compelled to return to a more neutral policy stance if the impact of previous tightening has yet to be fully realized. Finally, while tariffs and trade negotiations could introduce a wide range of outcomes, the Fed seems likely to look through the short-term inflationary impact of tariffs, focusing instead on their potentially negative long-term implications for growth and productivity.

As a result, the Fed may be unlikely to adopt a more hawkish stance preemptively, based on the new administration's policy proposals. Both the Fed and markets are expected to remain data-dependent in the year ahead.

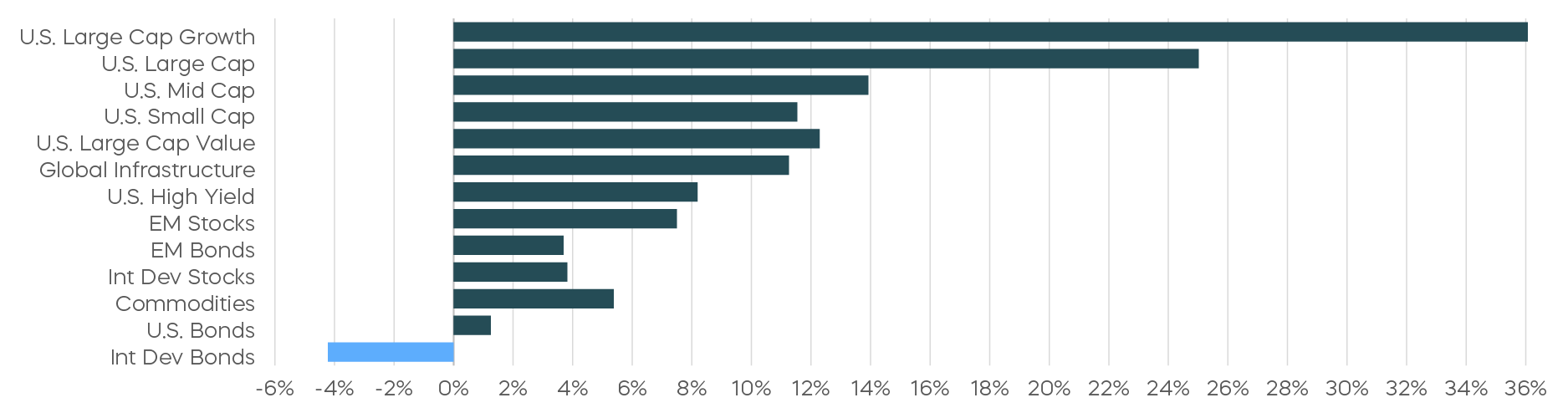

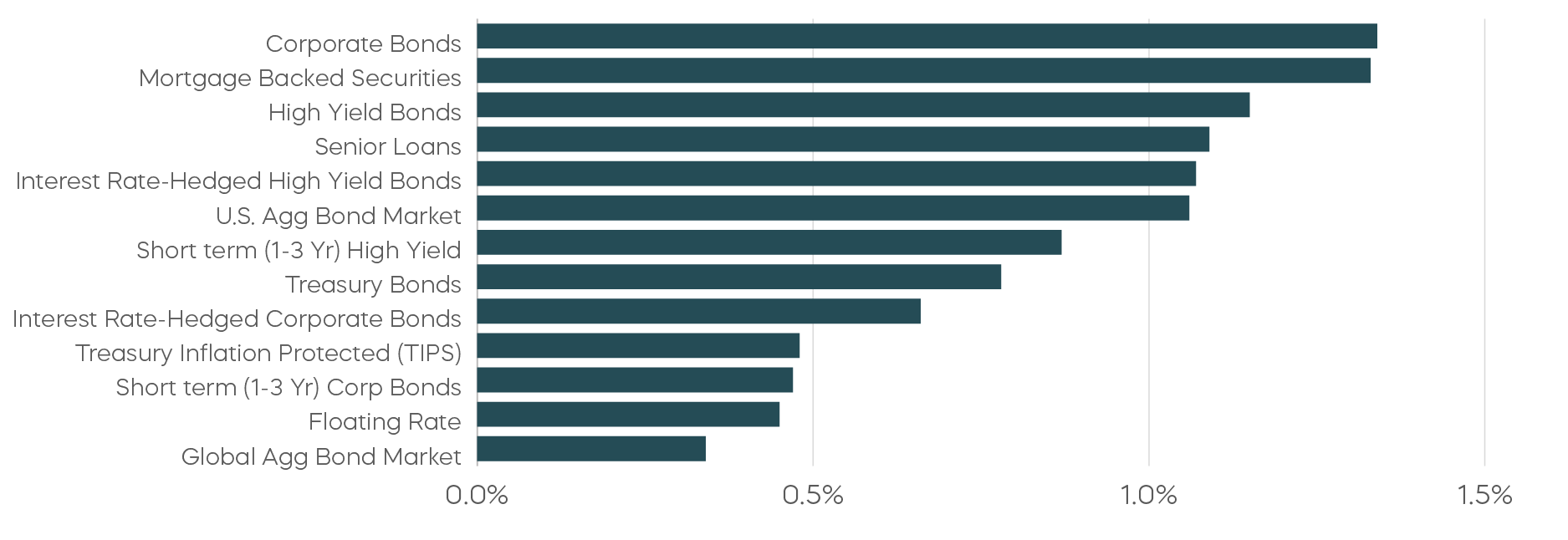

Credit markets extended their rally in a post-election, risk-on environment. Year-to-date, higher-yielding credit segments delivered strong performance, with high-yield bonds outperforming leveraged loans on a relative value basis. Treasury Inflation-Protected Securities (TIPS) and mortgage-backed securities outpaced Treasuries, while global fixed income underperformed relative to US counterparts.

Fixed Income Returns—Year-to-Date

The impact of policy changes remains uncertain and may take time to fully materialize. The trajectory of interest rates could hinge on the neutral rate of interest, which itself may be shaped by the policies ultimately enacted. On balance, we anticipate that the Federal Reserve will maintain its easing bias, while rising growth and inflation risks could contribute to a steepening yield curve.

As the tail risks of runaway inflation subside, fixed income is regaining its appeal as a portfolio diversifier. This role of diversification is particularly relevant, given that credit spreads currently appear priced for perfection, leaving little room for further compression. While the credit cycle may still have room to run, fixed-income returns should primarily come from yield rather than price appreciation. Consequently, fixed income assets that not only generate income but also provide effective portfolio hedging may be preferable in an uncertain policy environment.

[1] Source: Bloomberg, data as of 10/31/24.

[2] Price-to-earnings (P/E) shows how much investors are paying for a dollar of a company's earnings. P/E helps to assess the relative value of a company’s stock by measuring its share price relative to its earnings. A high P/E could mean that a stock is overvalued.

[3] Source: Bloomberg, data as of 11/3/24.

[4] Source: Bloomberg, data from 3/1/23 to 3/31/23.

[5] Source: Standard & Poor’s and ProShares calculations.

Sources for data and statistics: Bloomberg, FactSet, Morningstar, and ProShares.

The different market segments represented in the performance recap charts use the following indexes: U.S. Large Cap: S&P 500 TR; U.S. Large Cap Growth: S&P 500 Growth TR; U.S. Large Cap Value: S&P 500 Value TR; U.S. Mid Cap: S&P Mid Cap TR; U.S. Small Cap: Russell 2000 TR; International Developed Stocks: MSCI Daily TR NET EAFE; Emerging Markets Stocks: MSCI Daily TR Net Emerging Markets; Global Infrastructure: Dow Jones Brookfield Global Infrastructure Composite; Commodities: Bloomberg Commodity TR; U.S. Bonds: Bloomberg U.S. Aggregate; U.S. High Yield: Bloomberg Corporate High Yield; International Developed Bonds: Bloomberg Global Agg ex-USD; Emerging Market Bonds: DBIQ Emerging Markets USD Liquid Balanced.

The different market segments represented in the fixed income returns charts use the following indexes: Global Agg Bond Market: Bloomberg Global-Aggregate Total Return Index Value Unhedged USD; Mortgage Backed Securities: Bloomberg U.S. MBS Index Total Return Value Unhedged USD; Treasury Bonds: Bloomberg U.S. Treasury Total Return Unhedged USD; U.S. Agg Bond Market: Bloomberg U.S. Agg Total Return Value Unhedged USD; Corporate Bonds: Bloomberg US Corporate Total Return Value Unhedged USD; High Yield Bonds: Bloomberg U.S. Corporate High Yield Total Return Index Value Unhedged USD; Interest Rate-Hedged High Yield Bonds: FTSE High Yield (Treasury Rate-Hedged) Index; Treasury Inflation Protected (TIPS): Bloomberg U.S. Treasury Inflation Notes TR Index Value Unhedged USD; Short term (1-3 Yr) High Yield: Bloomberg U.S. Corporate 0-3 Year Total Return Index Value Unhedged USD; Senior Loans: Morningstar LSTA U.S. Leveraged Loan 100 Index; Short term (1-3 Yr) Corp Bonds: Bloomberg U.S. Corporate 1-3 Yr Total Return Index Value Unhedged USD; Floating Rate: Bloomberg U.S. FRN < 5 yrs Total Return Index Value Unhedged USD; Interest Rate-Hedged Corporate Bonds: FTSE Corporate Investment Grade (Treasury Rate-Hedged) Index.

The S&P 500 is a benchmark index published by Standard & Poor's (S&P) representing 500 companies with large-cap market capitalizations. The S&P 500 Daily Covered Call Index seeks to measure the performance of a long position in the S&P 500 TR and a short position in a standard S&P 500 daily call option, aiming to reflect higher income generation and lower timing risk by using daily options versus monthly options. The S&P 500 Dividend Aristocrats Index targets companies that are currently members of the S&P 500 that have increased dividend payments each year for at least 25 years. The S&P MidCap 400 is a benchmark index published by Standard & Poor's (S&P) representing 400 companies with mid-cap market capitalizations. The S&P MidCap 400 Dividend Aristocrats Index targets companies that are currently members of the S&P MidCap 400 that have increased dividend payments each year for at least 15 years. The S&P 500 Growth Index measures constituents from the S&P 500 that are classified as growth stocks based on three factors: sales growth, the ratio of earnings change to price, and momentum. The S&P 500 Momentum Index measures the performance of securities in the S&P 500 universe that exhibit persistence in their relative performance. The S&P SmallCap 600 is a benchmark index published by Standard & Poor's (S&P) representing 600 companies with small-cap market capitalizations. The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. The Russell 2000 Dividend Growth Index targets companies that are currently members of the Russell 2000 that have increased dividend payments each year for at least 10 years. The CBOE S&P 500 BuyWrite Index is a benchmark designed to show the hypothetical performance of a portfolio that engages in a buy-write strategy using S&P 500 call options. The Bloomberg U.S. Aggregate Bond Index or "the Agg" is a broad-based fixed-income index used as a benchmark to measure bond market performance. The Merrill Lynch Option Volatility Estimate (MOVE) Index is a measure of price volatility in government bonds. The Bloomberg U.S. Economic Surprise Index is a quantitative measure of how economic data releases compare to market expectations. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

This is not intended to be investment advice. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing involves risk, including the possible loss of principal. This information is not meant to be investment advice.

The “S&P 500®,” “S&P MidCap400,” “S&P 500 Daily Covered Call Index,” “S&P 500® Dividend Aristocrats® Index,” “S&P MidCap 400® Dividend Aristocrats® Index,” “S&P SmallCap 600,” and “S&P 500 Daily Covered Call Index” are products of S&P Dow Jones Indices LLC and its affiliates and have been licensed for use by ProShare Advisors LLC. "S&P®" is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”), and “Dow Jones®" is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and they have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. FTSE Russell is a trading name of certain of the LSE Group companies. ProShares ETFs based on these indexes are not sponsored, endorsed, sold or promoted by these entities or their affiliates, and they make no representation regarding the advisability of investing in ProShares ETFs. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.