After suffering sharp losses in 2022, technology stocks have rebounded with market-leading returns in 2023. Amidst a slowing economy, investors flocking to segments of the market offering attractive growth. Strong price gains, however, have left the technology sector trading at rich valuations. Increasingly, profitable tech stocks with mature business models have returned capital to shareholders through growing dividends. These well-established tech names can potentially offer a rare combination for investors—robust growth, with reasonable valuations.

Below we explore dividend growth technology stocks at a reasonable price.

Technology Sector Dominance

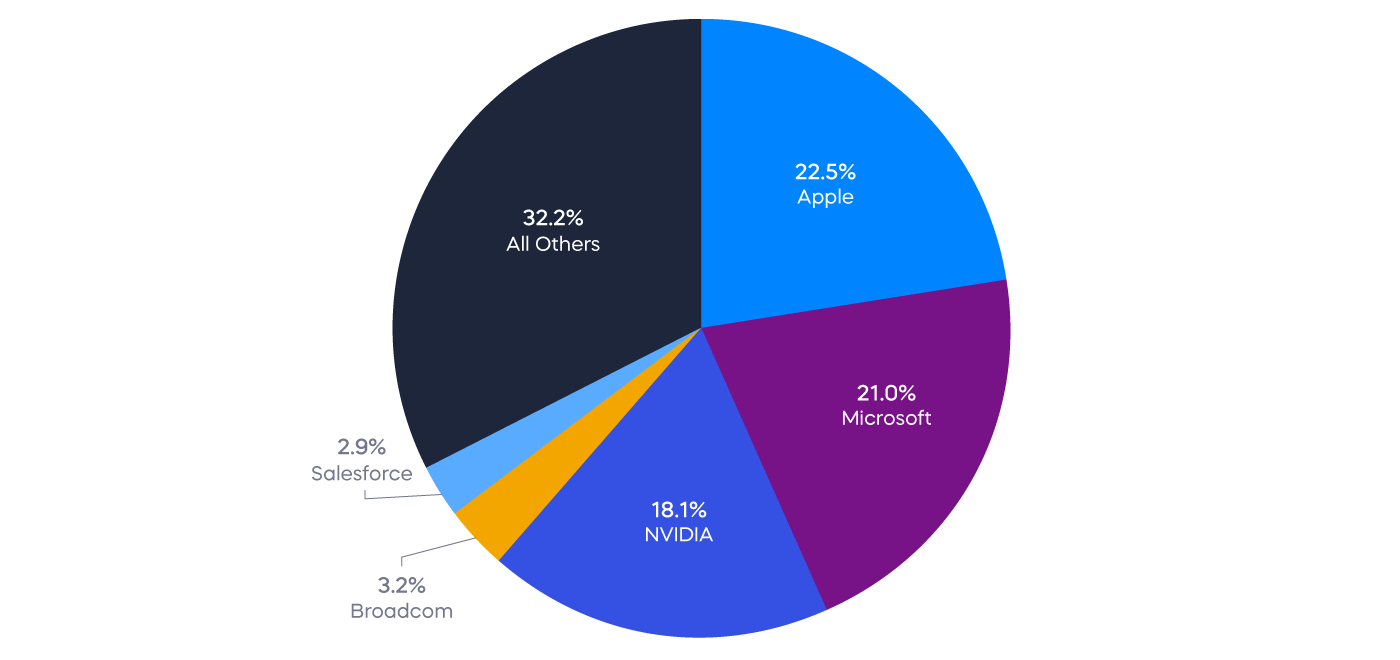

The S&P 500® has recently entered a bull market by rising over 20% from its lows in October 2022, and technology stocks have been doing most of the heavy lifting. Among the worst performers in 2022, information technology has led all sectors with returns of over 32% through May of this year. The largest tech stocks by market cap have done even better, returning an average of 76.8% year-to-date (FactSet, Morningstar, 6/30/2023). In fact, just five technology stocks have produced almost 70% of the S&P 500’s gains through May. As a result of their strong performance over the last several years, tech stocks now make up over 28% of the S&P 500—the index’s highest weighted sector—up from just 17% five years ago (FactSet, 6/23/2023).

Tech Stocks Have Powered S&P 500 Gains

Source: FactSet. Data through May 31, 2023

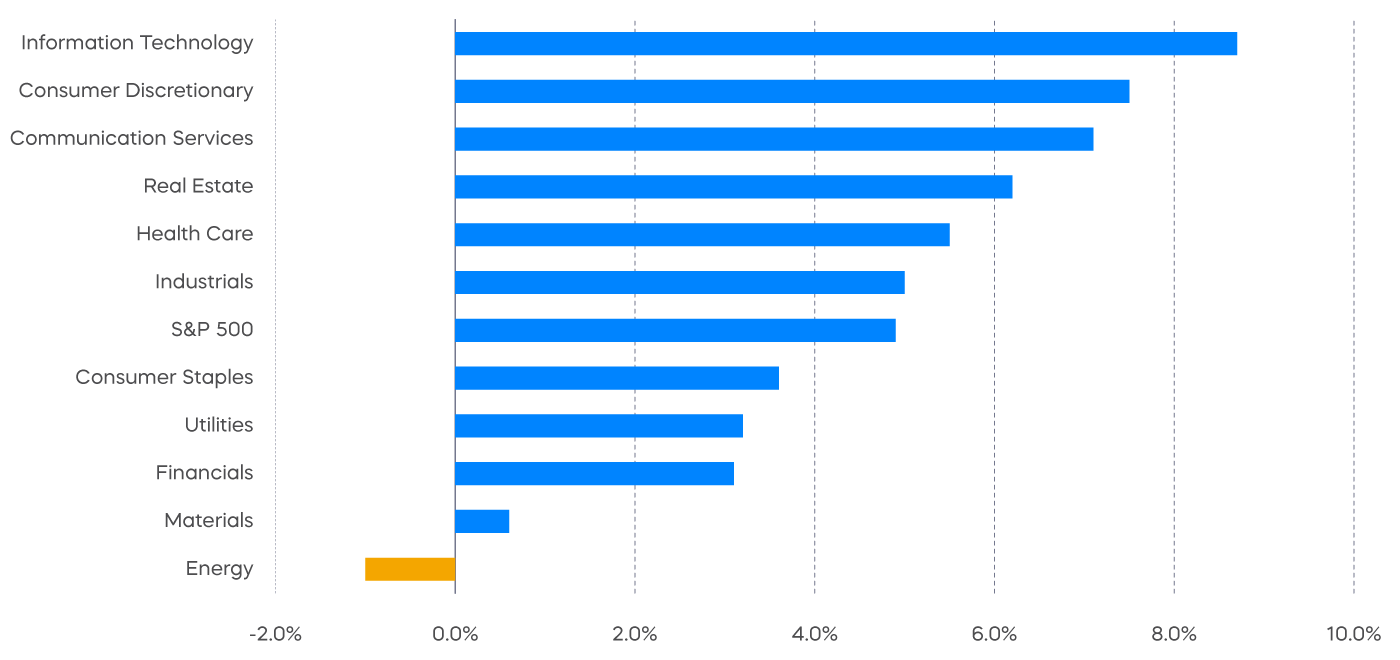

The dominance of technology stocks shouldn’t be surprising. With the Fed’s aggressive rate hikes, overall economic growth is slowing, and investors are putting premiums on market segments that are expected to deliver attractive growth profiles. The Bloomberg consensus forecast for GDP growth is just 1.1% for 2023, and an even more meager 0.8% for 2024. Meanwhile, tech stocks offer the highest estimated revenue growth of any sector for calendar year 2024. Tech stocks have been producing profit margins of 23%, the highest levels of margins of any sector, excluding real estate (FactSet, 6/23/2023).

2024 Revenue Growth Rates

Source: FactSet. Data as of June 23, 2023.

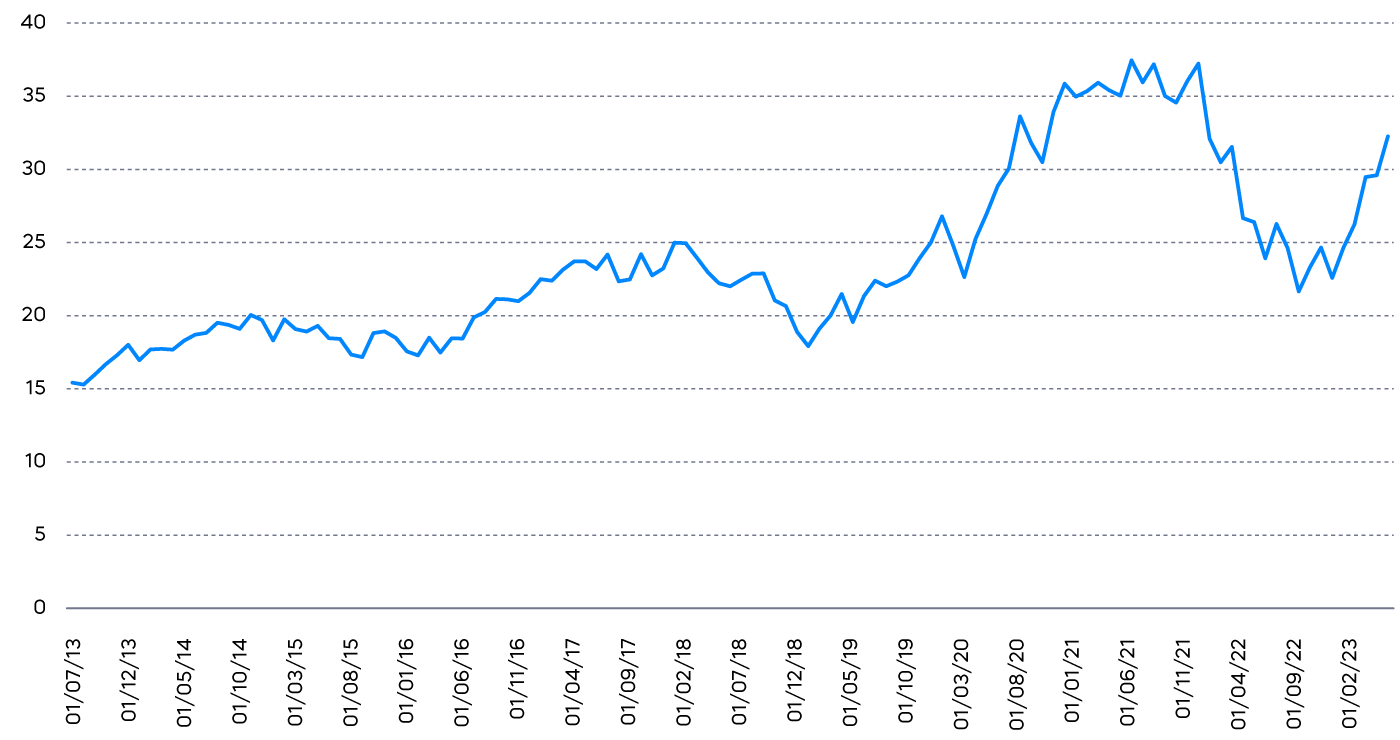

Are Valuations Too Optimistic?

If there is a downside to the rally in technology shares in 2023, it is that valuations are looking stretched. Powered in part by euphoria over the transformational potential of artificial intelligence, trailing 12-month price-to-earnings multiples for tech stocks have climbed steadily higher since the beginning of the year. They now stand at a lofty 33x earnings, meaningfully higher than the 10-year average multiple of 24x. Also notable is that the multiple expansion has been all “P” as in price, with little in the way of expected earnings growth, at least until 2024. The 2023 tech sector earnings growth rate is projected to be flat over 2022 levels.

Technology Sector Price-to-Earnings Multiples Are Stretched

Source: Bloomberg, data as of 6/26/23. The technology sector is measured using the S&P 500 Information Technology Index.

Technology at a Reasonable Price

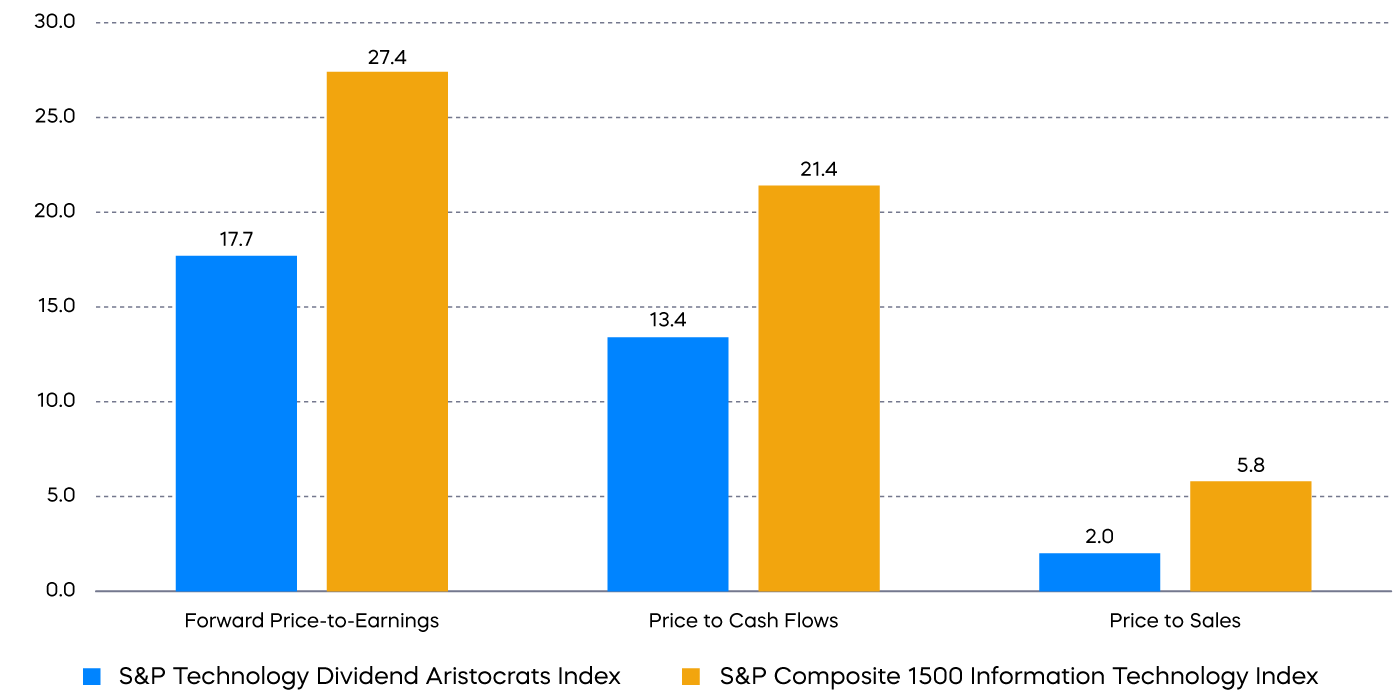

Asset allocators seeking attractively priced growth at a potential market inflection point seemingly face a dilemma. They can either overpay for growth or remain on the sidelines and potentially get left behind if the market continues to rally. A high-quality technology dividend approach with more reasonable valuations provides a potential solution.

Profitable tech stocks with mature business models—producing plentiful free cash flow—have increasingly been returning capital to shareholders through growing dividends. There are currently 38 members of the S&P® Technology Dividend Aristocrats® Index, which are tech and tech-related stocks that have grown their dividends for at least seven consecutive years. At a time when the S&P 500 earnings growth has been flat, the average Technology Dividend Aristocrat stock had increased its earnings by 21% as of their last fiscal year end (FactSet, 6/26/23).

Technology Aristocrats: Growth at a Reasonable Price

Source: FactSet; data as of 5/31/2023. Forward price-to-earnings (forward P/E) is a version of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation as a means of determining expectations for whether earnings will increase or decrease in the future. This is not a forecast of a fund’s future performance. Price-to-cash flow measures the value of a stock’s price relative to its operating cash flow per share. Price-to-sales uses a company's market capitalization and revenue to determine whether the stock seems to be valued properly. Past performance does not guarantee future results. Indexes are unmanaged, and one cannot invest directly in an index.

The Takeaway

Profitable tech stocks with mature business models have been returning capital to shareholders by way of growing dividends. The equal-weighted S&P Technology Dividend Aristocrats Index is a collection of technology related stocks that have grown their dividend for at least seven consecutive years. These well-established tech names have tended to offer a rare combination: robust growth at reasonable valuations.