The Risk of Technology-Sector Concentration

Sector concentration can be a double-edged sword. Sustained gains in a small group of stocks or in a single sector can lead market returns to new heights. But over time, such gains can also create the sort of excessive concentration that threatens returns when investor sentiment shifts suddenly. Both the recent and historical performance of the S&P 500 underscores this risk.

In December 1999, shortly before the burst of the Dot-Com Bubble, the technology sector made up nearly 30% of the S&P 500. By September 2002, after its crash, the tech sector’s weight in the index had fallen to just 12%. Since then, technology’s weight has steadily increased, achieving a more than 20-year high of 32.5% in December of 2024.

The S&P 500 Information Technology Sector’s Weight Has Increased Steadily

Source: FactSet, weight of GICS Information Technology Sector in the S&P 500 12/31/99–3/31/25.

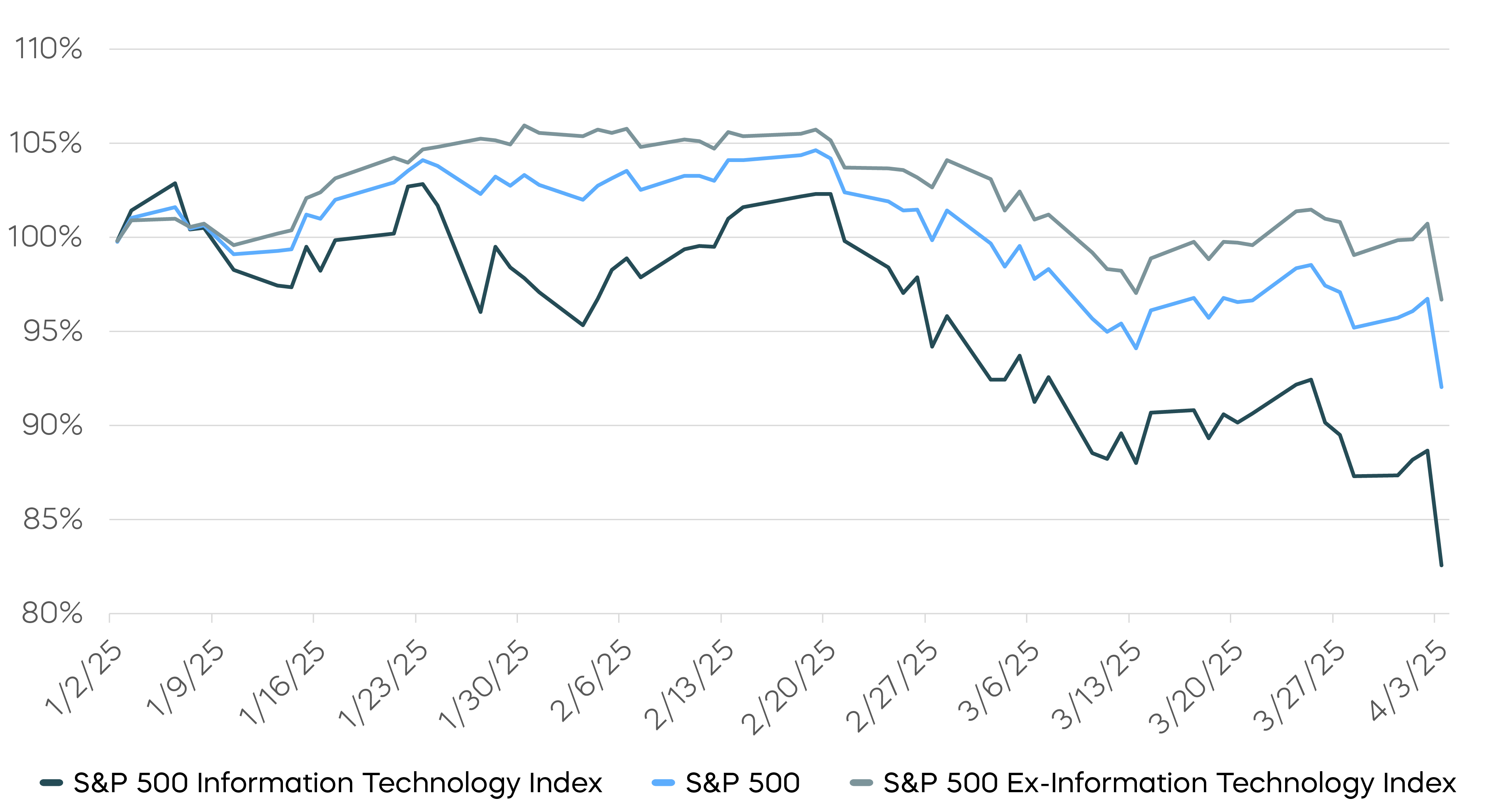

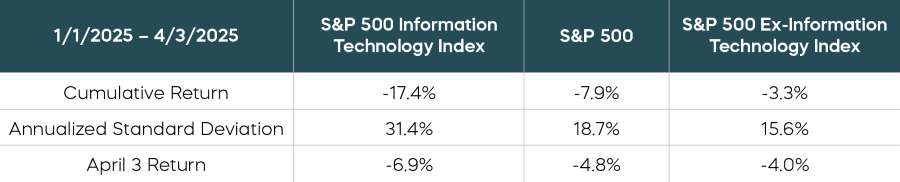

Unfortunately, in 2025, what once fueled gains has again become a drag on performance. With President Trump’s announcement of global tariff plans on April 3, 2025, S&P 500 returns suffered. The index declined 7.9% year-to-date through April 3rd, with much of that decline driven by tech—the S&P 500 Information Technology Index fell 17.4% during the period. Given the market-leading valuations of many tech companies before broader market weakness began, it’s not clear how vulnerable the sector may be to further disruption.

The S&P 500 Information Technology Index Has Declined Significantly

Source: FactSet, performance of the S&P 500, S&P 500 Information Technology Index and S&P 500 Ex-Information Technology Index 1/2/25–4/3/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Ex-Sector ETFs Offer a Solution to Reduce Tech Risk

ProShares Ex-Sector ETFs offer investors a way to invest in the S&P 500 while reducing or eliminating exposure to a specific sector.

For example, the ProShares S&P 500 Ex-Technology ETF (SPXT) is designed to track the S&P 500 Ex-Information Technology Index, which targets the performance of the S&P 500, while excluding companies in the tech sector. SPXT’s ex-tech strategy held up significantly better through April 3rd—both in terms of returns and volatility—versus the S&P 500 and the S&P 500 tech sector.

Click here for current and standardized returns for SPXT.

Source: S&P Global and FactSet, performance of the S&P 500, S&P 500 Information Technology Index and S&P 500 Ex-Information Technology Index 1/2/25–4/3/25. Index returns are for illustrative purposes only and do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

The Takeaway

ProShares Ex-Sector ETFs provide a compelling tool designed to strategically exclude a specific sector—technology, health care, financials, or energy—from the S&P 500 portion of an investor’s portfolio. Ex-Sector ETFs may be used to take a bearish position on a sector, but perhaps more importantly, they can be used to help diversify an investor’s already concentrated financial position in a sector because of market gains, their career path, stock options, an inheritance, or other reason.

Learn More

SPXT

S&P 500 Ex-Technology ETF

Excludes information technology companies, including software, technology hardware and equipment, and semiconductor companies.

SPXE

S&P 500 Ex-Energy ETF

Excludes oil, gas and consumable fuels, and energy equipment and services companies.

SPXN

S&P 500 Ex-Financials ETF

Excludes banks, diversified financials, such as consumer finance, asset management, investment banking and brokerage companies, insurance companies and REITs.

SPXV

S&P 500 Ex-Health Care ETF

Excludes pharmaceuticals, biotechnology and life sciences tools and services companies, and health care providers, equipment and services companies.