Tax-loss harvesting—i.e., selling investments with losses to offset capital gains elsewhere—can be a valuable strategy to potentially reduce an investor’s tax liability. However, after consecutive years of double-digit stock market rallies, investors might be out of ideas on where to look for opportunities to employ this tool.

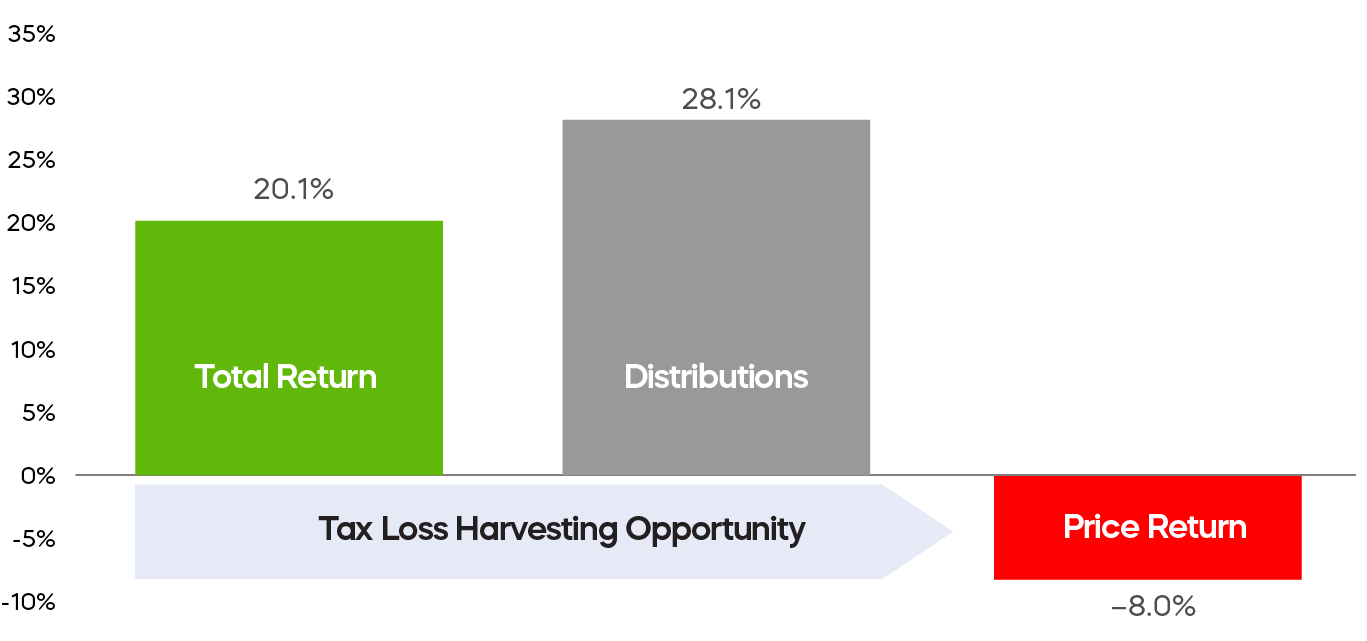

It’s often overlooked that tax-loss selling may even be possible when an investment has experienced a positive total return. How could that happen? Investors should be aware that some covered call ETFs have made taxable distributions that are greater than their total return, resulting in a negative price return—and a potential a tax-loss harvesting opportunity.

Negative Price Returns for Covered Call ETFs May Create an Opportunity for Tax-Loss Harvesting

Total Return = Capital Gain & Income Distributions + Price Return

Source: Morningstar, Bloomberg, ProShares Calculations. Total return and price return are weighted average returns of a group of covered call ETFs that represent 90% of the ETF assets under management in Morningstar Derivatives Income category as of 7/19/24. Only ETFs with at least 3 years of return history are included in the analysis. The return period is 6/30/21 – 6/28/24. Total returns assume reinvestment based on market price. Distribution is the implied difference between total return and price return.

If your covered call ETF’s share price is below its cost basis (illustrated above), consider harvesting a tax loss and repositioning your equity income allocation with a ProShares High Income ETF.

By utilizing a next-generation daily covered call strategy, ProShares’ suite of innovative High Income strategies can potentially improve the tradeoff between income and total returns, and provide the opportunity to:

- Seek high levels of income

- Target the returns of the S&P 500, Nasdaq-100, or Russell 2000 over the long-term

- Potentially capture the returns that monthly covered call strategies may sacrifice

Learn More

ISPY

S&P 500 High Income ETF

ProShares S&P 500 High Income ETF seeks investment results, before fees and expenses, that track the performance of the S&P 500 Daily Covered Call Index.

IQQQ

Nasdaq-100 High Income ETF

ProShares Nasdaq-100 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Nasdaq-100 Daily Covered Call Index.

ITWO

Russell 2000 High Income ETF

ProShares Russell 2000 High Income ETF seeks investment results, before fees and expenses, that track the performance of the Cboe Russell 2000 Daily Covered Call Index.