The boom-bust nature of tech, volatile energy markets, and a banking industry ripe for disruption are just a few of the tail risks that have complicated the investing picture in recent years. What alternatives do investors have other than to ride it out?

Unexpected economic shocks are often concentrated—and particularly painful—for a relatively narrow slice of the market. Avoiding a particular sector at the right time—through the use of an Ex-Sector ETF, for example—may offer a simple and potentially robust approach that can insulate a portfolio and enhance returns.

Historical episodes of sector turmoil are hard to forget, including the Technology sector’s 80%1 drawdown as the so-called “Dot-Com Bubble” burst in the early 2000s.

Recent Use Cases

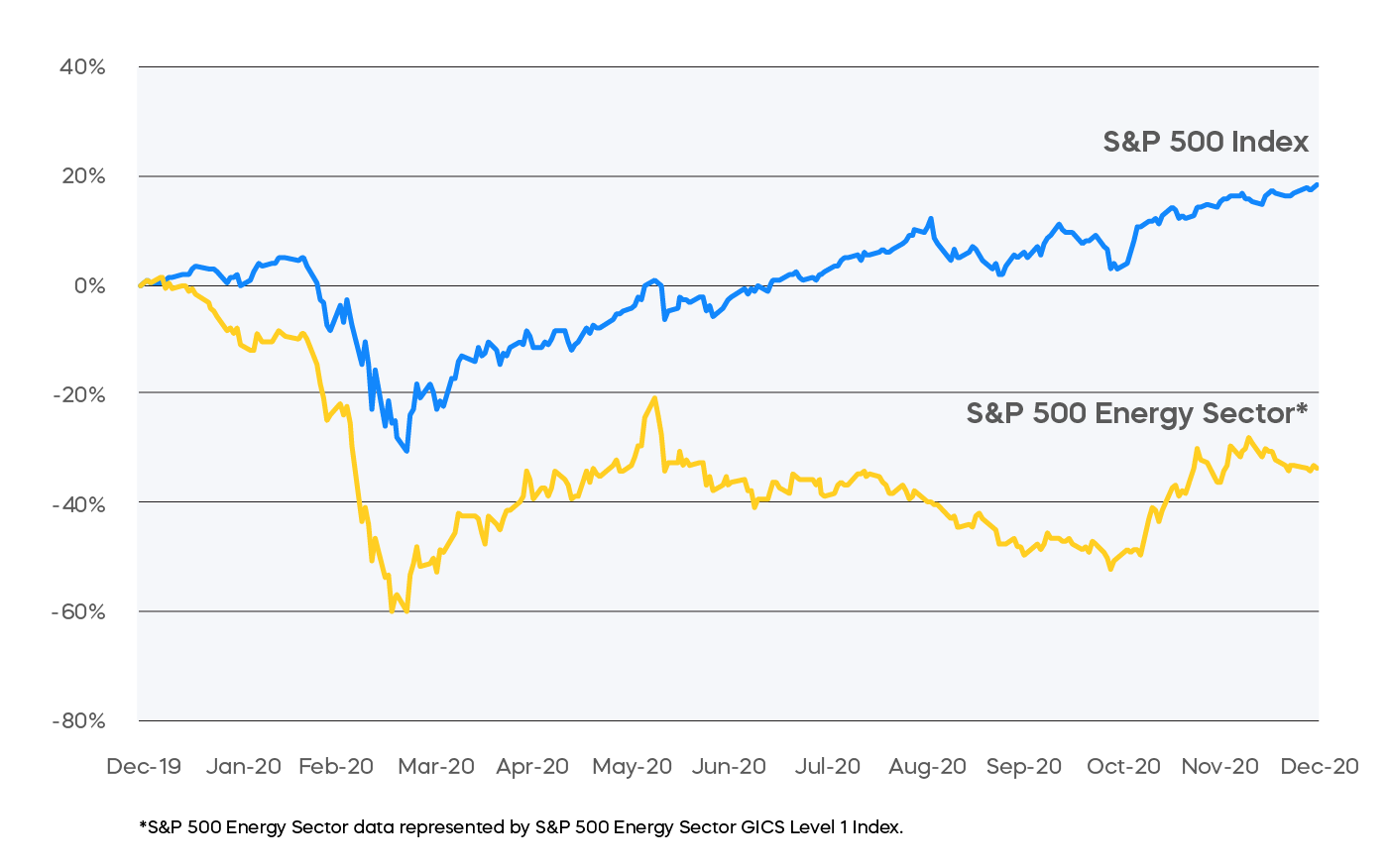

Energy Stocks Suffered at Onset of Pandemic

More recently, a swift economic recovery from the pandemic, a sharp rise in inflation, and aggressive monetary policy have contributed to further bouts of sector turbulence. In each of these market environments, the timely removal of the volatile sector would have buoyed performance.2

For instance, in 2020, the Energy sector significantly underperformed the broad market as oil prices plummeted into negative territory at the onset of the pandemic, with economic activity on pause. Energy was also slower to recover as other sectors roared back over the second half of the year. This divergence illustrates how vulnerable any given sector can be—and why the option to exclude a sector might benefit investors.

Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

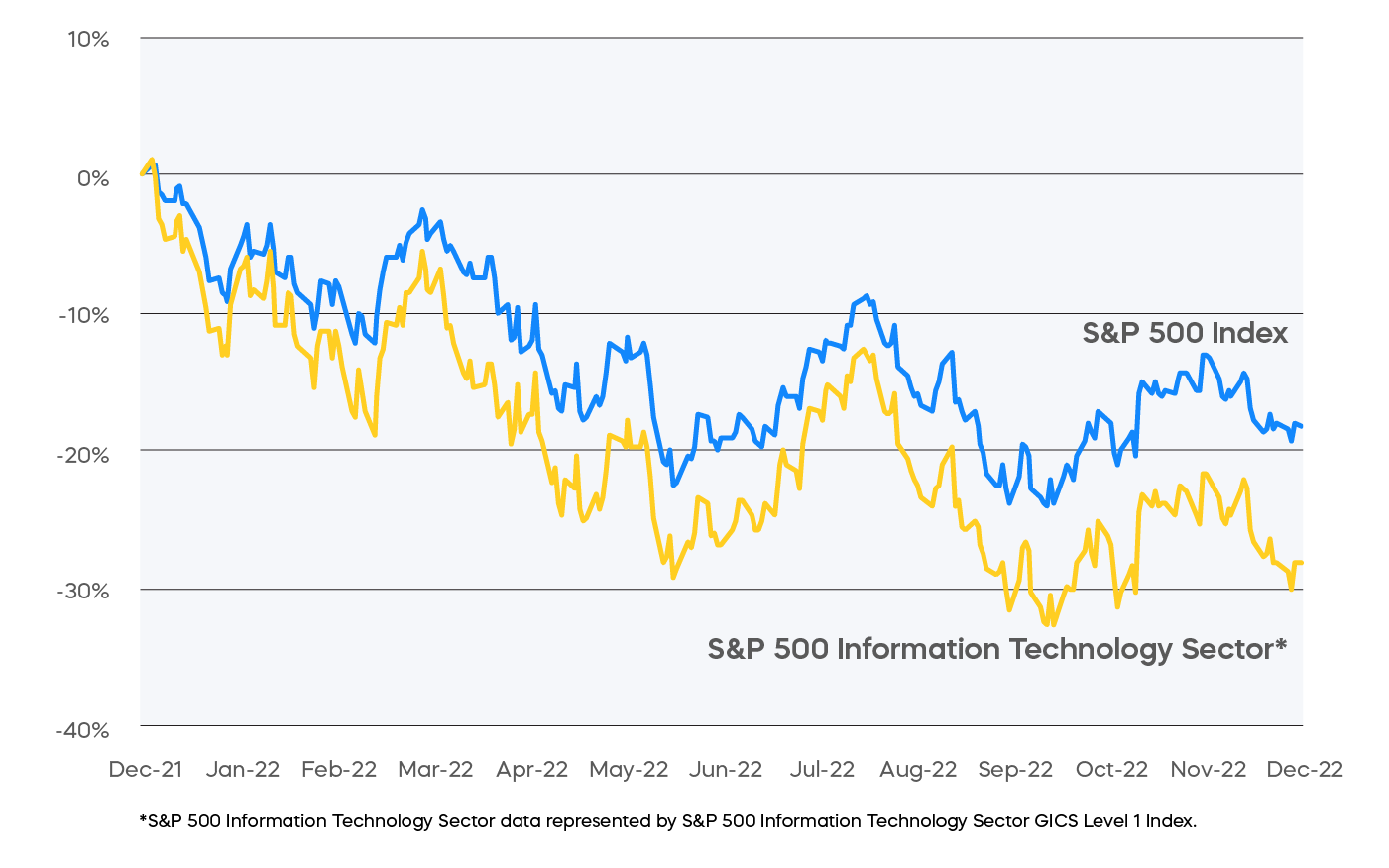

Inflation Upset the Tech Rally

Following a rally in the second half of 2020 and 2021, markets subsequently sank in 2022, due to higher-than-anticipated inflation and tightening monetary policy. The Technology sector—which many believe disproportionately benefited from the preceding era of low rates—struggled as a result. Investors who excluded tech from their portfolios during this period were better positioned to mitigate losses.

Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

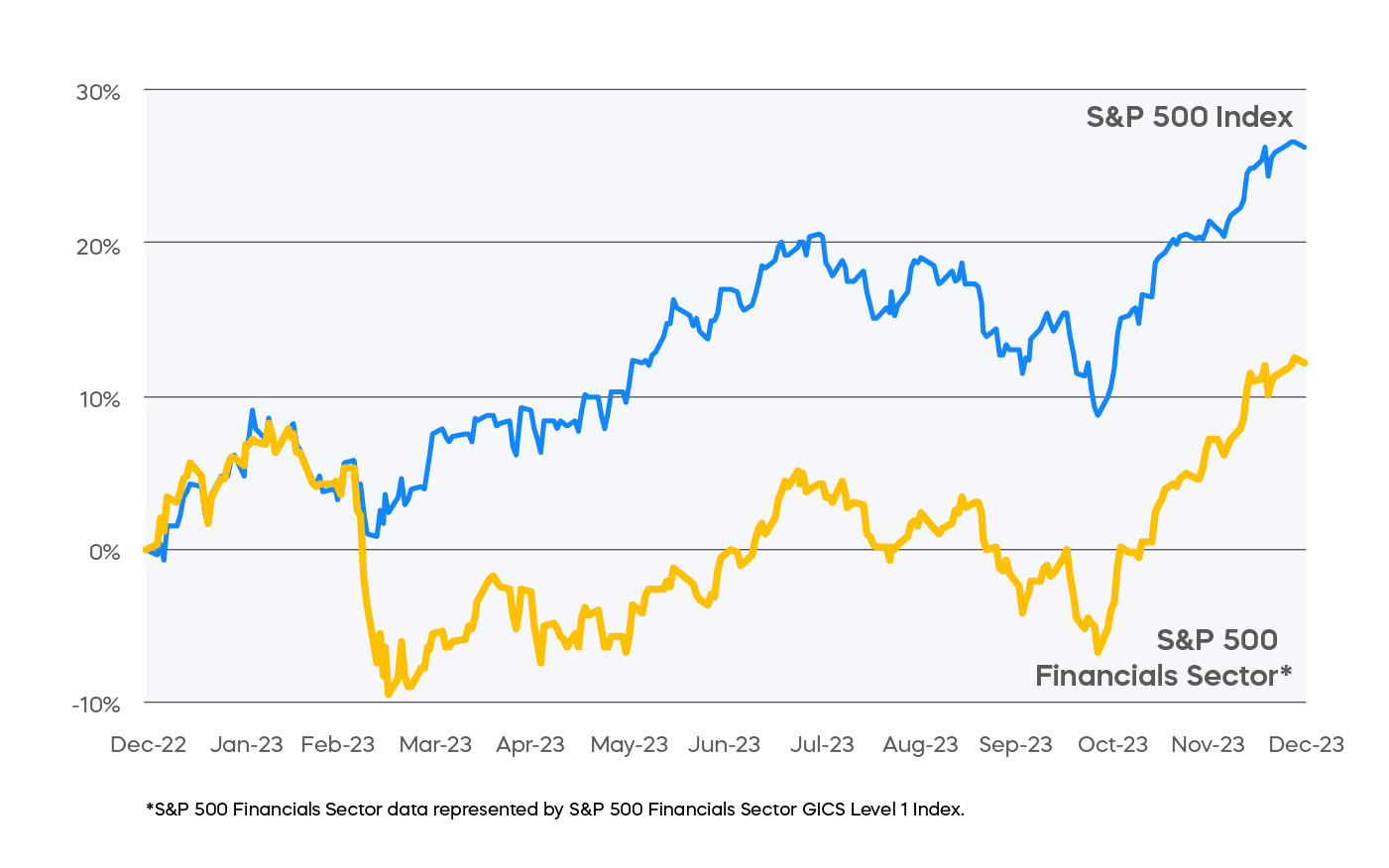

A Black Swan Bankruptcy Sunk Finance

As interest rates spiked in early 2023 in response to inflation, the Financials sector suffered outsize losses, with numerous regional banks failing due to mismanagement of rate-sensitive balance sheet risks. Many were caught off-guard, after a 15-year period of historically low interest rates. By steering clear of Financials during this time, investors could have better shielded their portfolios from significant losses.

Index returns are for illustrative purposes only and do not represent actual fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

The Upshot

The potential benefits of insulating a portfolio from a particular sector in the midst of disruption has proven its value over recent years.

Most investors adhere to some common principles, like the benefits of diversification3 and compounding over time. The long-term performance of the S&P 500 is proof of these principles at work. However, it is also true that the cap-weighted S&P 500 can grow surprisingly concentrated, as we’ve seen with the rise of ‘Big Tech.’ Concentration in one sector, by definition, means the displacement of another. Energy is complicated by geopolitics and competing incentives around the transition to renewables; Financials are confronting the impact of FinTech, cryptocurrencies, and volatile interest rates; while the Health Care sector faces the challenge of a graying population and the potential for regulations that could upend businesses.

When storm clouds emerge, pulling out of the market entirely has rarely been a good move. But the potential benefits of insulating a portfolio from a particular sector in the midst of disruption has proven its value over recent years. In a world where many expect the pace of disruption to only accelerate, thanks to a confluence of technological, ideological, and demographic factors, we believe Ex-Sector ETFs deserve consideration in an S&P 500 investor’s toolkit.

1Source: Bloomberg. Data from 9/1/00 – 10/9/02.

2Source: Bloomberg. Data as of 12/31/23.

3Diversification does not ensure a profit or guarantee against a loss.

Learn More

SPXE

S&P 500 Ex-Energy ETF

Excludes oil, gas and consumable fuels, and energy equipment and services companies.

SPXN

S&P 500 Ex-Financials ETF

Excludes banks, diversified financials, such as consumer finance, asset management, investment banking and brokerage companies, insurance companies and REITs.

SPXT

S&P 500 Ex-Technology ETF

Excludes information technology companies, including software, technology hardware and equipment, and semiconductor companies.

SPXV

S&P 500 Ex-Health Care ETF

Excludes pharmaceuticals, biotechnology and life sciences tools and services companies, and health care providers, equipment and services companies.